Bullets:

It’s now understood that China has deep and durable monopolies on nearly all the Rare Earth metals and critical minerals.But each of those minerals poses unique challenges to Western countries who hope to build supply chains for them.Gallium is instructive. It is a crucial component for the most advanced electronics used in defense, and in civilian sectors.But gallium is produced as a byproduct of aluminum smelting, from bauxite. Only while smelting hundreds of millions of tons of bauxite ores to extract aluminum, can engineers extract a few hundred tons of gallium.Most smelters in Western countries have closed, and bauxite mining and aluminum smelting today are dominated by China, Russia, and India.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Initiatives to “re-shore” gallium production in the United States suffer from two defects. Our smelters never bothered to extract gallium in the first place. And in order to produce trace amounts of gallium, the bauxite and aluminum smelting industries need to be rebuilt.

The YouTube video for this report may be found here:

Report:

Good morning.

The entire world is now aware of the rare earths problem, and that China dominates the supply chains for nearly all of them.

And each one of those rare earths, along with the critical minerals and metals, presents unique and enormous challenges to Western countries who want to bring those supply chains back. And even saying that requires some caveats, some conditions, because for many of those metals, we never had them in the West, and still don’t.

We’re looking at gallium today, which isn’t a rare earth metal, but a critical one. And as we go through consider that the problems we’ve got for doing anything about China’s dominance in gallium, are similar to all the other metals.

China has a virtual monopoly in gallium, which is a big problem for the Pentagon and weapons makers. This report came out at the same time Beijing cut off exports of gallium for dual-use purposes, so too little too late Washington and NATO realize they need to de-risk their supply chains. China produces 98% of the world’s supply of gallium, and that derives from where gallium is hauled out of the ground. Gallium is a byproduct of processing bauxite, which is the primary source for aluminum ores.

China has a huge aluminum mining and processing industry, and the Western world does not. After bauxite is mined and then smelted, it’s then that the engineers can extract the gallium. But the objective for the bauxite mining is aluminum. Years ago Beijing required aluminum miners to extract the gallium, instead of just tossing it away, and in ten years Chinese production of gallium went from 22 tons to 444 tons.

Four hundred tons doesn’t seem like a lot, and it certainly isn’t, compared to the aluminum. But that 20 times’ increase in gallium supply blew up the market everywhere else, and suppliers in Europe and Kazakhstan shut down, and China was left as the world’s only producer.

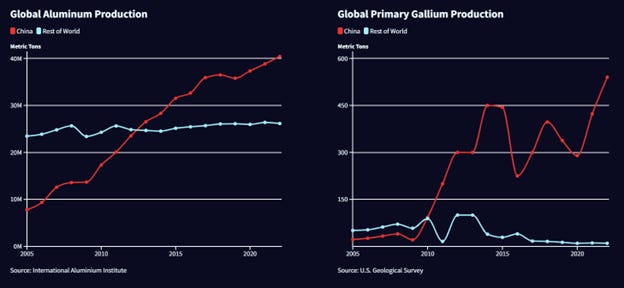

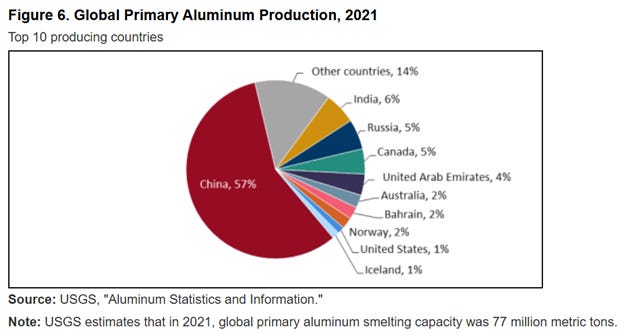

We see in these two charts the problem, the first is how much aluminum is produced by countries not named China: Since 2005, aluminum production for the rest of the world, combined, is around 25 million tons per year. China, since 2005, went from 8 million tons to over 40 million tons, up 5 times. On this chart is the global production of gallium. Rest of the world again in blue, dropping to about zero, with China going the other way:

So now China has it all – the smelters that used to go after gallium in NATO countries have all closed now, and the Pentagon is racing around, looking for more. Weapons makers need gallium to power their semiconductors for missile defense, radar, electronic warfare, and communications gear. And that’s all because gallium has chemical properties that are ideally suited to those applications: high temperatures, high voltages, and high frequencies are no problem for gallium-based chips.

Applications with gallium compounds have also been developed and applied, in military and industrial sectors. Gallium arsenide is used for GPS systems, precision-guided munitions, and smartphones. Gallium nitride is needed for the most advanced radars, stealth and missile defense systems, and in US navy ships themselves. Civilian companies need the chips for 5G towers, solar power, and electric vehicles, for the same reasons that the Pentagon likes them for high-performance applications: their efficiency and durability.

System by system, gallium is everywhere. Gallium chips power dozens of RF systems and radars. Optoelectronics, for lighting, LIDAR, and lasers. Power equipment: spacecraft, fast charging, data centers, power grid management. And clean energy.

And when we flip through all those applications that require gallium to work, and understand that in order to build them, we need either China to give it to us, or figure out how to make it ourselves. But it’s the chicken-and-egg problem: gallium comes from bauxite mining and smelting, and the reason to do that is for the aluminum industry, and we don’t have one.

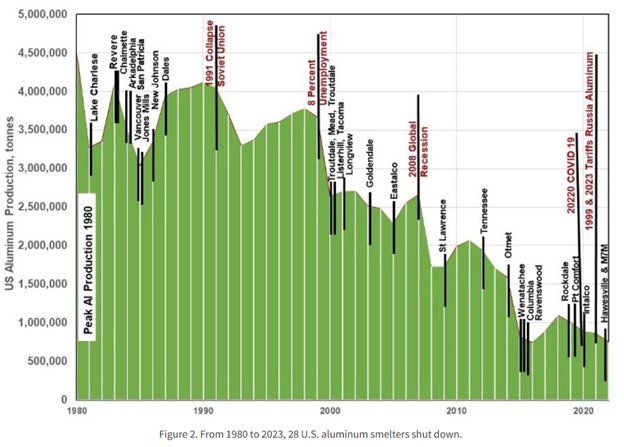

Once upon a time, the United States was one of the biggest aluminum producers in the world. Twenty-eight aluminum smelters in the US, open for business for decades, but one by one they shut down. Here is a chart of US aluminum production, the green bars, and in black the smelter shutdowns:

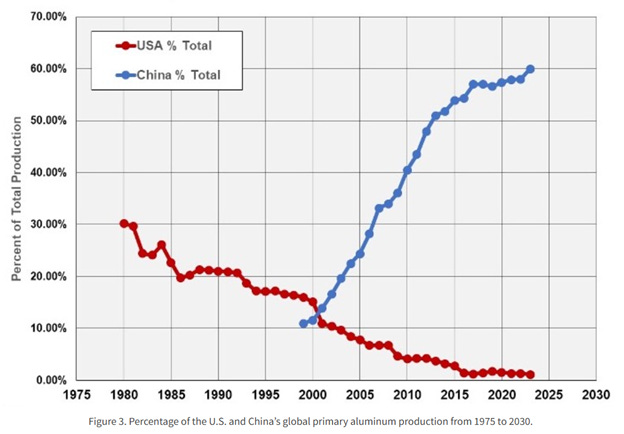

Production peaked in 1980 and has gone toward zero, slowly but surely, ever since. So here’s another chart, US and China compared, with the percentage of global production, moving decisively in opposite directions:

And remember that getting gallium separated from the rest of the bauxite ores was never an industry in the United States anyway.

And another one for China vs rest of the world, and not a lot of good news there for Pentagon contractors. China, India, and Russia combine for about 70% of aluminum production, and should go without saying how the BRICS countries have no interest in helping NATO build more missiles and stealth aircraft.

Beijing understood early on what their giant aluminum operations meant for gallium, and what gallium means for everything that will power the rest of this century. In their five year plan from 2021, gallium was a key part of the strategy to challenge the West, technologically.

Today, that race is over. China now does enjoy first-mover advantages in all those technologies. For advanced industrial applications, and military-grade equipment where money is no object and engineers demand gallium instead of silicon, China has vaulted ahead of the US, Europe, and Japan.

Then came the export bans which deny Chinese gallium to anyone that might be building anything for the Pentagon, and weapons makers and the heads of civilian companies are waking up to the vulnerability. Of all the metals, gallium ranks the highest in terms of both economic vulnerability and disruption potential, because so much of our expensive stuff relies on gallium, and China can easily shut it off:

The report concluded with a series of recommendations, and the first is to invest in gallium extraction and refining in the United States, supported by the Department of Defense.

And here we might wonder if the analysts read their own report. Nothing happens with gallium outside of aluminum mining and smelting, and nobody is doing that anymore in the United States. It may be that there are giant piles of processed ores sitting around these abandoned smelters that nobody bothered to get the gallium out of, and maybe the plan now is to break all those rocks apart, again.

But that’s something our engineers have never done before either. Remember that Beijing required its aluminum smelters to go after the gallium. They reason they had to be told to—that they weren’t bothering to separate the gallium—was because it’s hard work. It’s a lot of time and money to go after just four hundred tons of gallium out of hundreds of millions of tons of bauxite. Chinese aluminum producers didn’t think it was worth their trouble, so Beijing told them to get the gallium, or lose their license. It’s a different world today, and they have it all.

Be Good.

Resources and links:

The Critical Minerals to China, EU, and U.S. National Security

https://elements.visualcapitalist.com/the-critical-minerals-to-china-eu-and-u-s-national-security/

How Much Control China Has Over the World’s Critical Minerals

https://www.visualcapitalist.com/how-much-control-china-has-over-the-worlds-critical-minerals/

Figure 6. Global Primary Aluminum Production, 2021

https://www.congress.gov/crs-product/R47294

Decline of U.S. Primary Aluminum Production and the Growth of Secondary Aluminum

De-risking Gallium Supply Chains: The National Security Case for Eroding China’s Critical Mineral Dominance

USGS critical minerals review

https://apps.usgs.gov/minerals-information-archives/articles/usgs-critical-minerals-review-2021.pdf

A model to assess industry vulnerability to disruptions in mineral commodity supplies

https://www.sciencedirect.com/science/article/pii/S0301420722003348

Mineral Monopoly: China’s Control over GalliumIs a National Security Threat

https://features.csis.org/hiddenreach/china-critical-mineral-gallium/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed