Bullets:

Fertilizer prices are soaring again, after Chinese and Russian suppliers sharply reduce exports.Both are top producers of fertilizers, and previously supplied export markets. But China is locking up its supplies for its surging domestic market, as well as for its factory sector.Russian fertilizers are now under sanction by the European Union, and farmers in the Eurozone are struggling to find suppliers elsewhere across the world. Since 2022, Russian exports of fertilizers are down over 80%.American farmers are not nearly as reliant on imported fertilizers. But the shortages caused by Chinese and Russian export policy are pushing up prices by double-digits, even on US farms, as domestic fertilizers suppliers can freely raise prices to meet new market demand from Europe.The YouTube video for this report may be found here:

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

The trade wars have exposed how reliant North American and European factories are, for raw materials inputs from China, and from other BRICS countries. Decoupling isn’t possible at all, and high tariffs we put on imports just lead right away to tighter supplies and higher prices back home. That’s because there are no substitutes at lower prices in our own markets, and often there aren’t substitutes even at higher prices. So buyers must either pay the high tariffs, or go without.

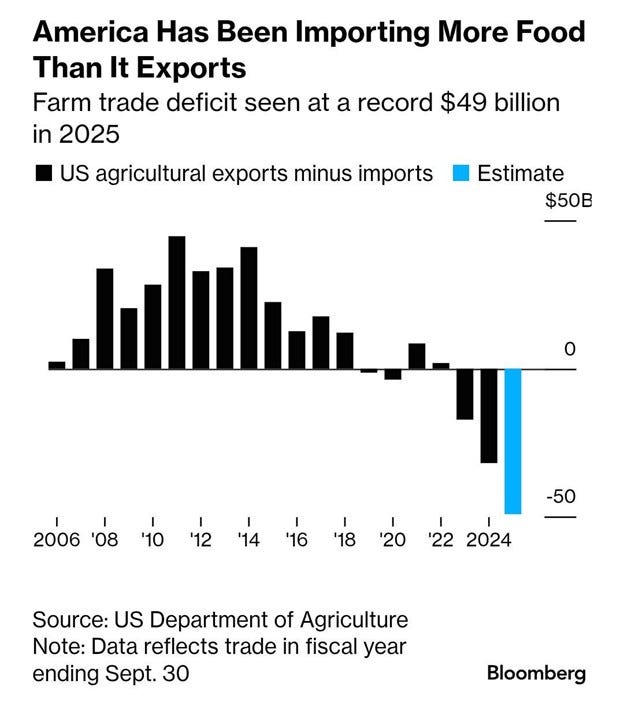

Now the same dynamic is hitting farmers in Western countries. It’s commonly believed that we are self-sufficient in food, that we export surplus food to the rest of the world and that other countries would starve otherwise. But that hasn’t been true for a long time, and the United States now is a net food importer—we import more food than we export, on a dollar value basis:

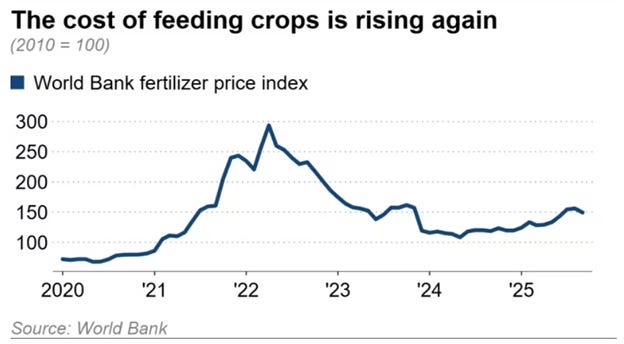

And the agricultural sectors in the US and Europe are heavily dependent on imported fertilizer to grow crops. Now the countries that produce that fertilizer are choosing to keep it for themselves, to grow their own crops, and prices are zooming higher.

China and Russia are two of the top producers for fertilizers. Diammonium phosphate fertilizers are up 34% this year. On this historical chart for the fertilizer price index, it looks at first glance as if fertilizer is on sale, and trending lower:

But the Ukraine war is an extreme outlier that pushed prices up to record highs, and the index is over three times the level in 2020.

Fertilizer prices are surging again, for two primary reasons. First up is China, who shut off exports of urea and DAP. Analysts suspect Beijing is just keeping their fertilizer for themselves, to ensure their own farms, which are expanding, are well supplied. Another explanation for the Chinese curbs comes from their manufacturing sector, as phosphate is a critical material for electric vehicle batteries.

The second reason is the European Union sanctions on Russia, which along with Belarus are key fertilizer suppliers for European farms. The EU put new tariffs on imports of fertilizers, pushing prices up, so European farmers are shopping for them in other markets. Europe has limited only production of potash. So these new tariffs on Russian fertilizers are simply forcing European farmers to pay a higher price to bring them in from farther away.

Prices for fertilizers are going up, around the world, even in the United States, which doesn’t rely nearly as heavily on imports. Fertilizer inputs add up to 18% of total production costs for soybeans, and 35% for wheat and corn. Fertilizer is a key cost driver, and the prices are going higher. The phosphate fertilizers are growing faster in price than the others, but potash is rising too.

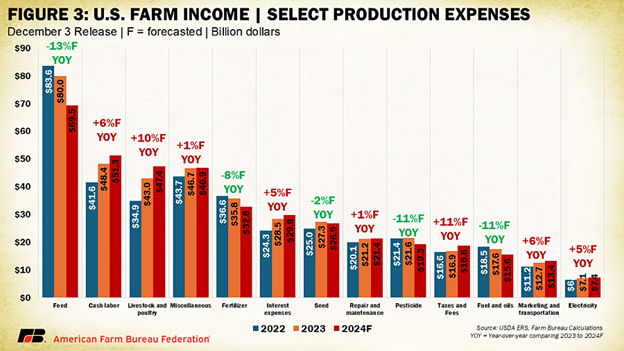

And so the chart above is a little bit misleading, because it appears that fertilizer costs are falling, as a percentage of overall farm expenses. And that part is true. But the bad news is that the other inputs are going up even faster than the fertilizer costs. Electricity, farm labor, interest payments, rent, property taxes are shooting up, along with the cost of farm machinery. Now farmers have no idea what the prices on fertilizer are going to be next week, let alone for the next planting season:

When we consider the US position on fertilizer, and the sources for it, it seems like this is a manageable problem. Almost all the potassium-based fertilizers in the American market come from domestic sources, at 97%. For nitrogen fertilizers the US imports 18% of what is used, and for phosphates it’s just 13%.

But remember that European farmers aren’t allowed to buy from Russia anymore, and China has shut off almost everybody else. Russia is also keeping much more for themselves anyway; their exports overall are just a fifth of what they were before 2022.

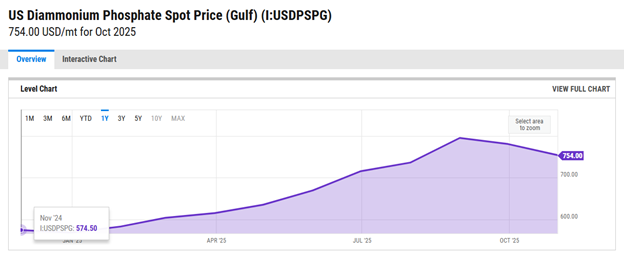

So domestic suppliers–American fertilizer producers–are raising their prices. Gulf DAP is diammonium phosphate sourced from the Southern United States, and phosphate producers there are having one of their best years ever. A year ago DAP traded at $574 a ton, now it’s over $750 a ton:

Those higher farm costs, across the board, are a major problem for North American farmers. In order to survive, they need to win back export markets that have gone to South American farmers, and to farmers in Africa. Countries that are friendly with China and Russia, and especially farmers in China and Russia, have access to low-cost fertilizers, and tools, and so enjoy higher productivity compared to farmers in Europe or the United States.

Be Good.

Resources and links:Nikkei, China export controls emerge as factor in rising fertilizer priceshttps://asia.nikkei.com/business/agriculture/china-export-controls-emerge-as-factor-in-rising-fertilizer-pricesFertilizer Outlook: Global Risks, Higher Costs, Tighter marginshttps://www.fb.org/market-intel/fertilizer-outlook-global-risks-higher-costs-tighter-marginsUS Diammonium Phosphate Spot Price (Gulf) (I:USDPSPG)https://ycharts.com/indicators/us/_diammonium/_phosphate/_spot/_price/_gulf#%3A~%3Atext=27+05%3A47-%2CBasic+Info%2C31.49%25+from+one+year+ago.Fertilizer prices on the rise for farmers, ranchershttps://texasfarmbureau.org/fertilizer-prices-on-the-rise-for-farmers-ranchers/The US Has Never Imported So Much foodhttps://financialpost.com/pmn/business-pmn/the-us-has-never-imported-so-much-foodTop U.S. Food Imports by Origin countryhttps://www.visualcapitalist.com/cp/us-food-imports-by-country/2024 Farm Income Decline Confirmed in USDA updatehttps://www.fb.org/market-intel/2024-farm-income-decline-confirmed-in-usda-update

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed