Bullets:

A decade ago, China had the world’s biggest garbage problem. Trash was piled 50-stories high in Jiangcugou, the country’s largest landfill, and forced its closure 20 years ahead of schedule.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

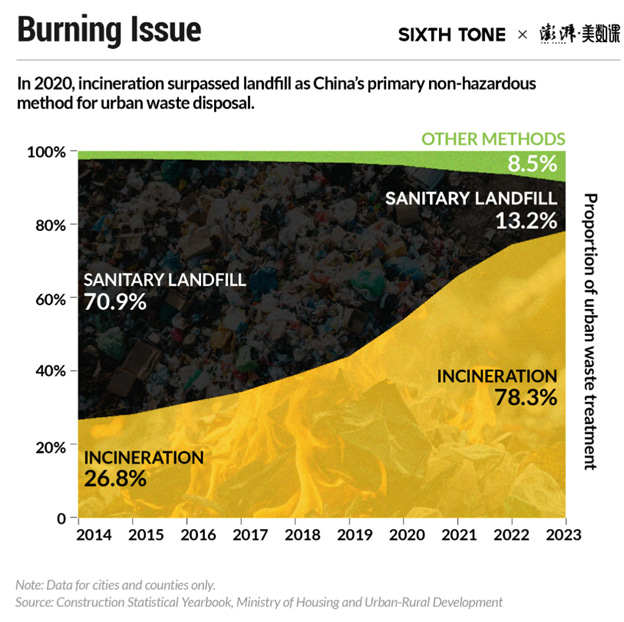

The country turned to incinerators, which burn household and some industrial waste to generate electricity. Today, 78% of Chinese trash heads to incinerators.

The proliferation of Chinese incinerators, the most efficient in the world, has created a garbage shortage across the country. Waste incineration capacity exceeds China’s generation of garbage, and some plants are idled for months at a time.

China is now aggressively exporting Waste-to-Energy systems, especially in markets here in East Asia.

This is a transcript, for the YouTube video here:

Report:

Good morning. Overa decade or so, China went from being smothered by garbage to running a shortage of it. The Jiangcungou landfill was the biggest garbage dump in China. When it was built in 1994, it was expected to run for 50 years. But it had to close in just 30 years. It’s the size of 100 football fields, and was taking in 10,000 tons of waste, per day. The incoming trash increased 10 times in 25 years, and was piled 50 stores high. It became “massively overburdened”, handling four times more trash than it was designed for.

In 2017, China was producing 215 million tons of trash from urban households, or city residential, excluding industrial. Landfills were filling up, so the government responded by requiring waste sorting, and banning imports of trash from abroad. But China also introduced incineration plants, and by 2020 over half of China’s garbage went to incinerators, instead of to landfills, and it has been growing ever since. Now just 13% of China’s trash goes to landfills, while over 78% is burned to create electricity.

These incinerators are state-of-the-art. This is a waste-to-energy plant in Shenzhen, which burns 5,000 tons of waste per day, and generates 550 million kilowatt hours of electricity annually. Its roof is covered in solar panels, which are sufficient to generate the power needs for the plant itself.

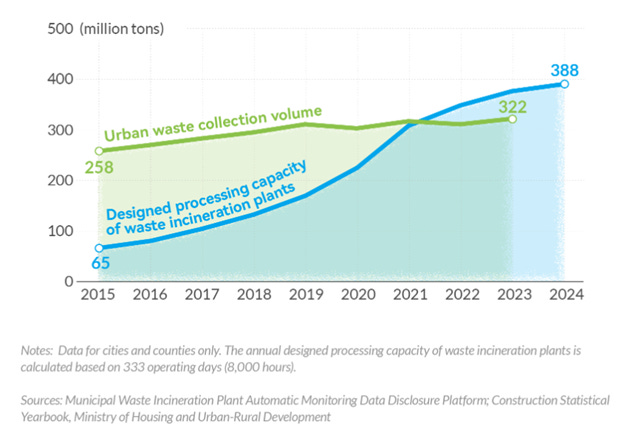

These incinerators have been so successful, so fast that their capacity now is greater than the waste generation rate across the country:

That line was crossed in 2021, and today there is about 70 million tons excess capacity for waste incineration, compared to how much waste is generated. That means that some plants are idled, with operations suspended pending new supply. Last year over half had uptime rates of over 90%, but over a hundred incinerators were offline for more than six months.

So China today ironically has an “unexpected garbage shortage.” WtE is “Waste to Energy”, and China has more WtE plants than the rest of the world, combined. Their WtE also score high in thermal efficiency. Those efficiencies at scale mean that China generates a huge share of their electricity, just from burning household trash. In Hainan, for example, each ton of waste is good for about 350 kilowatt hours of power, which means that burning the trash from five households converts to the electricity needs of one household.

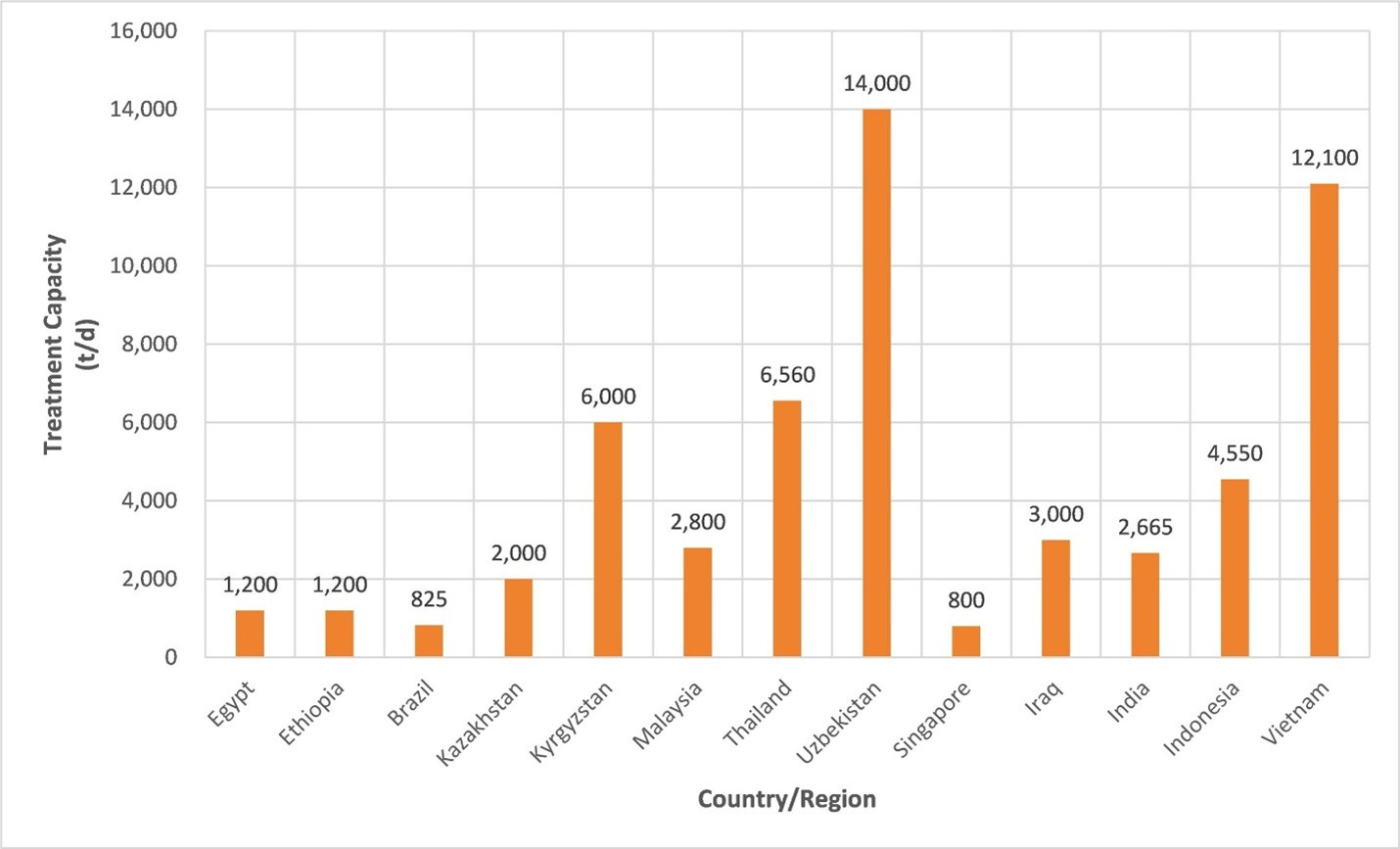

China’s now at capacity for Waste-to-Energy plants, and so is expanding to foreign markets. $600 million in Chinese plants are planned for Kazakhstan, and it’s the same lesson here in this industry we’ve seen lots of other ones. China now dominates the world in WtE tech, because China had the world’s biggest problem to solve, to begin with. Then China’s supply chains and industrial centers got busy building the equipment for the industry, and soon enough could build the equipment at higher quality and lower cost than anyone else.

Chinese firms build capacity at $250 per ton, which makes these WtE plants an obvious choice for neighboring countries.

The best markets for the equipment are here in Central Asia and South Asia. Uzbekistan, Vietnam, Kyrgystan, Kazakhstan—these face same problem China itself had twenty years ago. Chinese companies that build this equipment are best in class, but their domestic market is full. Now they’re cranking up their export markets, and these countries are spending $250 per annual ton upfront to build plants that will turn their landfills into electricity, forever.

Be Good.

Resources and links:

Shenzhen East Waste-to-Energy Plant

https://www.sbp.de/en/project/shenzhen-east-waste-to-energy-plant/

Which Chinese Company Leads the Waste-to-Energy Expansion Overseas?

Turning Trash into Treasure: Chinese Waste-to-Energy Projects in Central Asia

https://chinaglobalsouth.com/analysis/china-waste-to-energy-central-asia/

Chinese Firm to Invest $600 Million in Waste-to-Energy Plants in Kazakhstan

https://timesca.com/chinese-firm-to-invest-600-million-in-waste-to-energy-plants-in-kazakhstan/

China turns trash into green growth, expands waste incineration industry overseas

http://m.cnhubei.com/gundong/p/19281139.html

China’s Waste Revolution: Turning Garbage into Energy

Do China’s Waste Incinerators Have Enough to Burn?

https://www.sixthtone.com/news/1017314

China’s Largest Dump Fills Up 20 Years Ahead of Schedule

https://www.sixthtone.com/news/1004838

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed