Bullets:

China’s factory sectors require massive volumes of Rare Earth materials and magnets to fuel their domestic needs.Some industry insiders now insist that Chinese demand has caught up to supply, and export restrictions are necessary to keep domestic industries well supplied.There are obvious national security issues involved, if Chinese officials allow the export of materials that eventually end up in foreign weapons systems.But it also represents a huge opportunity cost to Chinese factories and households, if those minerals and magnets are sent elsewhere. Low-cost vehicles, electricity, and consumer products in China’s domestic economy also are dependent on the same inputs as Pentagon weapons makers and foreign factories.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

We spend a lot of money on subscriptions and paywalled articles, and pay for Substack newsletters that are emailed to us. This one comes from Stephen Chen, the science news editor at South China Morning Post. And his perspective here is really compelling.

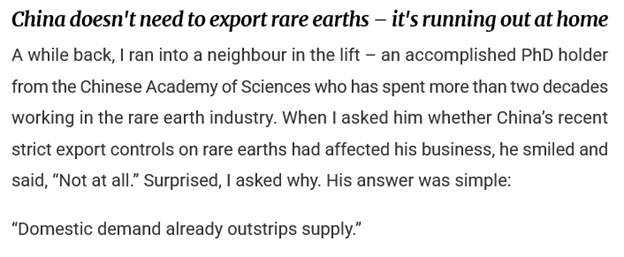

He’s on the elevator with a Chinese doc working with rare earths, who said that Chinese demand from Chinese rare earth metals is now higher than Chinese production of them.

On the one hand, this is obviously anecdotal, just two guys talking on an elevator. But it points to a deep question, as to just how many rare earth metals get made, and how many get used, and by whom? We were talking about the rare earth metals and magnets problem here on this channel for a long time before the rest of the world realized what was going on, and that China has monopolies on the mining, on the separation and the refining, and the production of magnets that power everything in the modern economy.

So the global supply chains for all these technologies run through China, and the recent export bans by China are causing big problems for everyone outside China.

But what if there is a lot more to the issue, than just the trade wars, and the reluctance of BRICS countries to supply raw materials for Pentagon weapons systems? Those are reasons enough to cause Western business managers and policymakers lots of problems. But this is another serious complication, that these minerals and magnets are in high demand now here in domestic markets, and across China’s industrial sectors. So we’ll share Chen’s email in its entirety, and add some context as we go.

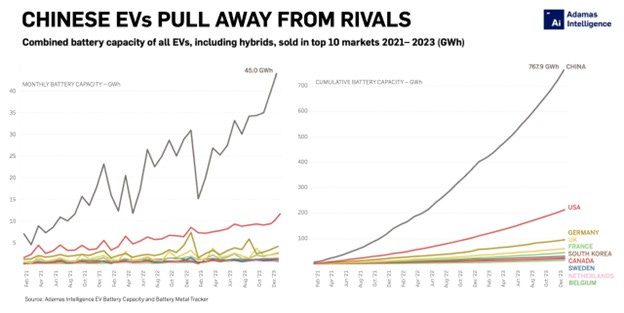

First up, is electric vehicles. 70% of the world’s EV’s are built in China, and each one gobbles up lots of rare earth materials to make the electronics work. The Chinese production of batteries and EV’s are parabolic, and far exceed the output of the rest of the world combined.

In 2023, Chinese built 58% of the fully electric and hybrid cars in the world. Five times more than the US, 7x Germany. And this is a theme we keep hitting, that all this production results in lower prices for Chinese households: The average selling price of Chinese cars are half that of American cars, and still falling sharply. Chinese car buyers have dozens of brands to choose from, at low prices, and they are stuffed with technology that is sourced from Chinese rare earth metals industries.

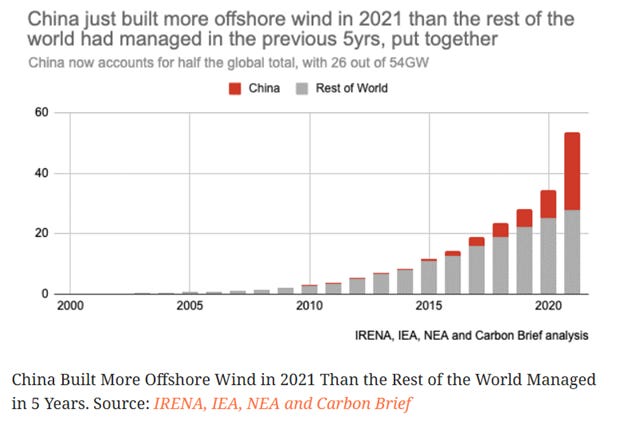

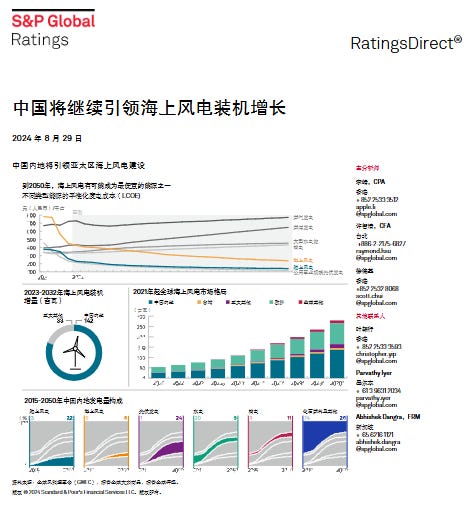

Up next is green power—solar and wind farms—which are also dependent on rare earths to work. China’s offshore wind is more than the rest of the world combined, and the industry has grown from five GW installed just seven years ago, to over 42 gigawatts today.

This is a chart of cumulative offshore wind deployed, and in 2021 alone, China built more than the rest of the world, combined, since 2016.

And a lot more wind projects are in the pipeline, so to speak. 593 gigawatts of wind power, that’s for off- and onshore, are in development now. This forecast from S&P Global goes through 2050, and concludes that China wind is going to grow much faster than solar:

Beijing’s five-year plan is their blueprint for what their economic goals and policies are, and everything in that thing points to far higher demand for rare earths, here in China. “Demand for rare earths will skyrocket.” The 2030’s are just a few years off, and Chinese firms will build millions of humanoid robots. Fusion nuclear reactors are under development, and we already know that China is building more conventional nuclear reactors than anyone else, and everyone else. And China’s military is rapidly modernizing, and are dependent on Chinese rare earths in the same way NATO forces are. Self-driving vehicles are another major demand driver.

And so it’s a different world today. “The situation is reversed.” China’s rare-earth export controls over 20 years ago didn’t work, because high-tech manufacturing was overseas, and Chinese households wanted those high-tech products, so those export bans were self-harming.

That was then, but this is now, and now it is Chinese manufacturers building those products, and so they enjoy a virtuous circle, a self-sustaining loop. It’s true that China’s controls on the exports of these materials are a powerful negotiating tool, but to domestic manufacturers it means that they will have the raw materials to build products for domestic consumers. It’s ordinary Chinese companies and households that benefit, able to buy affordable cars and electronics at better prices than anyone else.

With that perspective, these charts take on a whole new meaning. Western military platforms are dependent on Chinese rare earth metals and magnets to work, and charts like these get a lot of attention.

One of our guided missile destroyers needs 2,600 kg’s of rare earth minerals; a nuclear sub calls for 4,600. They are in every single system of an advanced aircraft, and to build a single missile we need Chinese rare earth elements from tip to tail, along with magnets made in China to tell it where to go. And so going back to Stephen Chen again, who reminds us that Chinese rare earths going anywhere except to factories here represent, to China, a huge opportunity cost.

It was obvious for years that the Pentagon can’t make their multi-billion dollar toys work without Chinese rare earth metals. And it was obvious that the only reasons China would agree to have them used in that way was because the United States and China were friendly — somewhat — and that Chinese demand for the metals had not yet caught up to Chinese supply. And that world that doesn’t exist today either.

Be good.

**Resources and links:**NATO focuses on rare earths for defensehttps://defence-blog.com/nato-focuses-on-rare-earths-for-defense/How rare earths could make or break the EU’s defence ambitionshttps://www.euractiv.com/news/how-rare-earths-could-make-or-break-the-eus-defence-ambitions/CHART: China’s global electric car dominancehttps://www.adamasintel.com/charts-china-global-electric-car-dominance/S&P Global, 中国将继续引领海上风电装机增长https://www.spglobal.com/ratings/documents/archive/zh/pdf/2024-8-29-power-sector-update-china-will-keep-its-lead-in-global-offshore-wind-additions.pdfChina’s solar and onshore wind capacity reaches new heights, while offshore wind shows promisehttps://globalenergymonitor.org/report/chinas-solar-and-onshore-wind-capacity-reaches-new-heights-while-offshore-wind-shows-promise/What the 2021 China Wind Power Boom Means for the worldhttps://energytracker.asia/what-the-2021-china-wind-power-boom-means-for-the-world/Visualizing How Rare Earths Power U.S. defensehttps://elements.visualcapitalist.com/visualizing-how-rare-earths-power-u-s-defense/Panic in global metals markets as China rare earth export bans close brokerage hubs

US price tag for China’s gallium export ban: $602 billion and new monopolies for Huawei

Statista, China’s Monopoly on Critical mineralshttps://www.statista.com/chart/35398/china-dominant-share-in-global-mining-production-of-critical-minerals/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed