Bullets:

China’s export bans on rare earth metals and magnets are crippling Western arms makers.But while the Pentagon is racing to find new supplies and jump-start the decades-long process of replacing China in their supply chains, their biggest contractors have been sending most of their profits and cash to Wall Street investors.Order backlogs today are hundreds of billions of dollars, for each of the major weapons makers. The Pentagon, along with NATO and other friendly countries, are waiting years for systems already ordered and paid for. Rather than re-invest necessary capital to build out manufacturing capacity, train and retrain top technicians, and fund new suppliers, companies spent tens of billions of dollars buying back their own shares, to push stock prices higher.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For the video presentation, please visit:

Report:

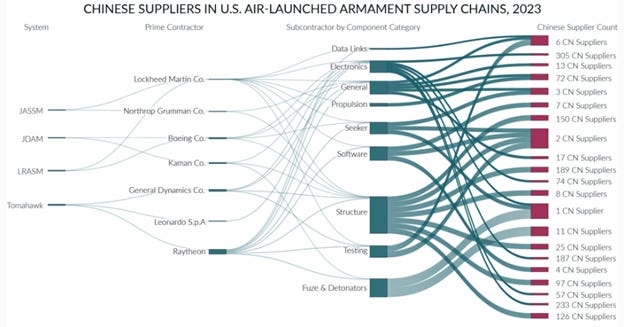

Good morning. China has supply chain monopolies on many of the critical components that Western weapons makers need. And that feature gets a lot of attention, that nothing really gets manufactured without going through China, and the Pentagon in particular is reliant on Chinese companies to get their weapons platforms built.

The dependency on Chinese companies to make weapons for NATO militaries shows up in surprising places. Our most important strategic platforms are reliant on Chinese semiconductors and chips, for example. And now everyone knows what the rare earth metals and magnets are, because China has cut off the exports of those and there’s no way to get those made in Europe or North America before 2040.

So our elected officials and defense contractors all pretend to want to do something about all that. But there is another problem much closer to home, which is that most of the profits Pentagon contractors make goes out the door to investors, instead of to build more capacity, or to build new supply chains for all the things that China and their friends in the BRICS countries own now.

Evidence for this is everywhere. Deliveries for the F-35 Stealth Fighter are falling farther behind, despite the Pentagon spending more money to speed them up. This comes from the US Government Accountability Office. The GAO found that the Defense Department paid billions of dollars to two primary contractors to build the F35 and their engines.

The DOD also pays out hundreds of millions of dollars in incentives to ensure timely delivery, but the companies are just pocketing the money. The delivery times are getting worse—in 2023 F-35’s were delivered 61 days late, on average, and last year was four times that—238 days. And in 2024, every single F-35 was delivered late. This, again, after millions of dollars were paid to speed up the deliveries.

Foreign buyers of American weapons systems aren’t doing any better. Switzerland ordered a big batch of Patriot missile systems, and the United States told them that the deliveries will be postponed, with no idea when they might arrive. Because of the war in Ukraine, “delivery priorities are being reorganized”, which is affecting Switzerland and everyone else who has outstanding orders.

In 2022 Switzerland bought five Patriot systems and 72 missiles for $700 million, with deliveries expected to begin next year. So back in 2022 there was already a 4-year backlog, and how long it takes now is anyone’s guess.

It is well understood that China’s exports ban on rare earth magnets, and the trade wars and tariffs on everything from our side, have screwed up supply chains around the world. But those issues are new, since early 2024 or so, and intensifying this year. So there is a key piece to the problem then that is not explained by China or the new Trump Administration. These are workers who were on strike at Lockheed Martin. Lockheed Martin is the prime contractor for both the F-35 and the Patriot missile systems. Line workers at Lockheed here insist that their pay isn’t keeping up with the cost of living. Instead, the money that the company earns is going to investors, instead of to new hires.

In 2024, Lockheed paid $6.8 billion to buy back their own shares and to pay dividends, and that $6.8 billion is more than the company retained in profits for the year.

And Lockheed is in good company here—Raytheon and Northrop Grumman both paid out $3.7 billion, and General Dynamics handed out $3 billion.

Company executives do all that because it results in higher stock prices. Above are the stock charts for Raytheon and Lockheed Martin, and if your own company doesn’t seem to be doing nearly as well as these guys, it’s because you’re probably not a Pentagon contractor in the age of free money and endless wars.

Quarterly earnings releases for all these companies look like this one here, from Raytheon last May: Raytheon is increasing the dividend, on track to return tens of billions of dollars to investors via dividends and share buybacks, and here is Raytheon’s 8-K form from last October for the third quarter; these are quarterly numbers: Free cash flow of $2 billion, an outstanding order book of $221 billion, and $1.1 billion returned to shareholders. So over half their free cash flow went back into investors pockets to juice quarterly returns, and not into doing much to dent their $221 billion order backlog. To repeat: Raytheon has $221 billion in pending orders, and they’re giving over half their profits back to Wall Street investors instead of bringing more capacity online.

This is already a familiar theme to us, and we’ve reported how in the American fire truck industry, for example, profits are being poured out to investors, while production lines get shut down. That has created a crisis for municipal governments and for firefighters, who are paying over $2 million for fire trucks that used to cost a fourth that, and who are waiting five years for trucks that they need today to put fires out.

Detached observers might look at how Wall Street has so financialized American life, with the incentives so perverse, and conclude simply that the financial industry is stealing from American fire departments and firefighters. Wall Street investors are stealing from small local governments, just as they’re also stealing from the Pentagon and from governments across the world.

And while it’s impossible to gin up much sympathy for the Pentagon these days, the result is the same: hundreds of billions of dollars of weapons that won’t be built for years, even though they’ve already been paid for. And the rank-and-file aren’t taking home giant paychecks, even though they’re in a critical industry when everyone is on a war footing. Jobs in defense are becoming less attractive. Turnover in defense and aerospace was 13 percent in 2023, nearly four times the economy at large, and defense contractors report that they are unable to find qualitied employees.

But that is because the money is already gone, to pay back Wall Street investors. An entry-level position at Lockheed Martin earns $15.45 an hour. By comparison, Buc-ee’s gas station offers starting pay for guys of $20 an hour, cleaning bathrooms. Buc-ees’ starting pay for washing cars is $21 per hour.

If you’ve never heard of Buc-ees, they’re an institution in the American south, and they are famous for having some of the cleanest bathrooms around. So to the Swiss government who is wondering why nobody is around to get their Patriot missiles built, good chance that the machinists who were working on them took a job at the happy beaver gas station, instead, for higher pay. And good chance also they sleep better at night after a long day of cleaning bathrooms and cars instead of building things that go boom in Ukraine or Gaza the day after shipping them out.

Today all these problems are hitting at once. The Ukraine war is being fought against what they are calling a “near peer” nation, which means one with deep industrial capabilities. And if we think of Russia as “near peer” for industry and production, we need to invent new language for what China represents, if push ever comes to shove with the Chinese. So now Lockheed and their peers need to build more weapons, and build them faster. And that is a problem for the contractors—they need to invest giant piles of capital to build up supply chains and train workers, but that means less free cash flow available to pay to investors. And in the case of Lockheed and the others, that second mandate—rewarding company investors—they’re eating their seed corn.

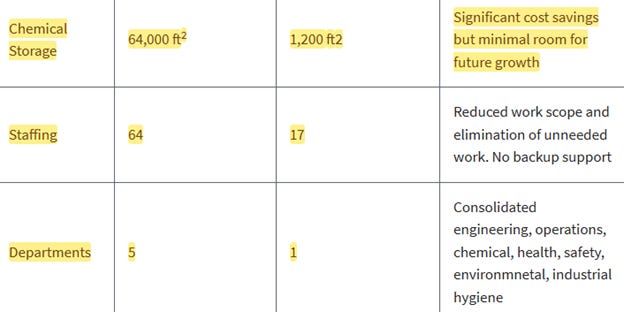

Lockheed line managers are reminded that they need to be constantly leaner, cutting costs and time, and people. This is from a case study on Lockheed Martin on the EPA website, and it ironically is celebrating Lockheed’s cost cutting and layoffs in its hazardous waste operations. It’s their LM21 Operating Excellence Initiative program for implementation of lean management systems. When this report was published, Lockheed claimed net savings of over $5 billion, “most of which are passed through to our customers.” That part certainly isn’t true anymore, if it ever was.

The report goes a few pages, but the results are above. Lockheed’s facilities for manufacturing were shrunk, by over a third. For chemical storage, the company went from using 64,000 square feet to just 1,200. Over there in the “benefits and concerns” column it says, “significant cost savings but minimum room for future growth.” About 2/3s of the employees in the division were laid off, and those who are still on the job have no backup support if one of them goes to work for Buc-ees.

This case study is on a website of the American government. And they’re congratulating a major defense contractor for closing manufacturing centers and laying off employees. There is not a single person from Beijing, or Moscow, or Teheran involved here. It’s American executives of American companies.

In 2023 Lockheed had $6.2 billion in cash flow, but gave their investors $9.2 billion in cash and stock. That extra $3 billion, then, came from new borrowing, and spending down cash reserves. But on the operations side, Lockheed cut 1% of its workforce. All that—layoffs and selling buildings used for manufacturing and cutting jobs in hazardous waste divisions and layoffs company-wide, these are suggestive of a company in deep trouble. But these companies were making more money than ever.

To emphasize again, these financial results are all from 2023 and 2024. These companies even then had order backlogs in the hundreds of billions of dollars, from the Pentagon and from friendly countries. At the same time the top managers of these companies were gutting their own industrial capacity, laying off their own best technicians, and draining their own cash reserves to hand over giant pools of capital to Wall Street. Now China has cut them off from the raw materials they need to build anything, and they don’t have any money or people left to do anything about it.

Be Good.

**Resources and links:**GAO, F-35 Joint Strike Fighter: Actions Needed to Address Late Deliveries and Improve Future developmenthttps://www.gao.gov/products/gao-25-107632America Doesn’t Have Enough Weapons for a Major Conflict. These Workers Know why.https://www.politico.com/news/magazine/2025/10/27/lockheed-martin-strike-orlando-weapons-missiles-00514386EPA, Lean manufacturing at Lockheed martinhttps://19january2017snapshot.epa.gov/lean/lockheed-martin_.htmlDue to the war in Ukraine, the U.S. informed Switzerland of delays in the delivery of new Patriot air defense systemshttps://www.zona-militar.com/en/2025/07/17/due-to-the-war-in-ukraine-the-u-s-informed-switzerland-of-delays-in-the-delivery-of-new-patriot-air-defense-systems/F-35 stealth fighter deliveries have been falling farther and farther behind, watchdog findshttps://www.businessinsider.com/f-35-stealth-fighter-deliveries-have-been-falling-behind-watchdog-2025-9RTX Board of Directors Increases Quarterly Cash dividendhttps://raytheon.mediaroom.com/2024-05-02-RTX-Board-of-Directors-Increases-Quarterly-Cash-DividendRaytheon Form 8-K, share buyback announcementhttps://investors.rtx.com/static-files/26fc7680-f4cb-46aa-9a31-2694743e5bedForbes, America’s Carriers Rely on Chinese Chips, Our Depleted Munitions toohttps://www.forbes.com/sites/erictegler/2024/01/09/americas-carriers-rely-on-chinese-chips-our-depleted-munitions-too/Panic and production cuts at Pentagon suppliers as China tightens exports

China’s new export ban on tungsten shocks defense contractors as Pentagon races to find new supply

Chinese factories build fire trucks for $400,000 in six weeks. In the US it’s $2 million in 4 years

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed