Bullets:

Major German companies are accelerating their capital investments and expansions in China.German policymakers insist that firms instead invest in Europe, where manufacturing industries are being hollowed out by high energy and labor costs, regulation, and collapsing consumer demand.But German firms cannot afford to leave China. The depth of Chinese supply chains would take years to replace, and at far higher costs. What’s more, Asia is where almost all the consumer market growth is, with double-digit booms in consumer class populations with disposable incomes.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

German companies are doubling down on their investments and expansions in China, despite warnings from German government officials who want them to rebuild manufacturing there. Investment by German firms into China increased 30% year over year in 2024, to 5.7 billion euro. From 2015 through 2019, those investments were 3.3 billion euro, so German FDI in China is increasing, and accelerating, despite all the trade wars.

German policymakers are less than happy about these trends, and are pushing Germany companies to change course. The problem is that the costs of getting out of China will do damage the German firms—if the companies leave, it’s expensive, and somebody is paying. Businesses will earn less money, and pay less in taxes. Workers will be laid off. German consumers will pay higher prices.

And of course there’s the supply chain problem: China has supply chains, and relocating out of here means they need to be built somewhere else, and more expensively, and that is a long process.

So the German government hopes to reduce their firms’ reliance on the Chinese supply chains for manufacturing, and for China’s consumer markets for sales. But whatever the German government proposes, either by way of domestic infrastructure investment, or subsidies to firms to make good their losses, it’s going to be expensive, and the German government can’t cover their obligations as is. Its finances are already stretched by their climate, defense, and welfare programs. So while it may be risky for Germany companies in China—if things go sideways diplomatically and Chinese regulators cut them off—until and unless that happens, they have no choice but to stay the course.

The Chinese market is critical for Germany’s automakers, for example, and China is the most important market for BMW, Mercedes, and VW. BMW just put over $4 billion dollars into building a battery hub in Shenyang, and exports electric SUV’s from China to Europe.

BASF is a chemicals company, and invested $9 billion US into new facilities in Guangdong. Bosch is laying off staff in Germany and building out new capacity here.

There is no getting around Chinese supply chains, nor the depth of engineering and manufacturing talent that’s here. Those are unsolvable problems, at least for the next decade, for policymakers in Europe and the United States who are pushing companies to decouple from China.

And while they complain about the dependencies our firms have on China’s factory sector to build anything in our own factories, there is another problem that there is absolutely no getting away from: it’s simply that this is where the world’s customers are.

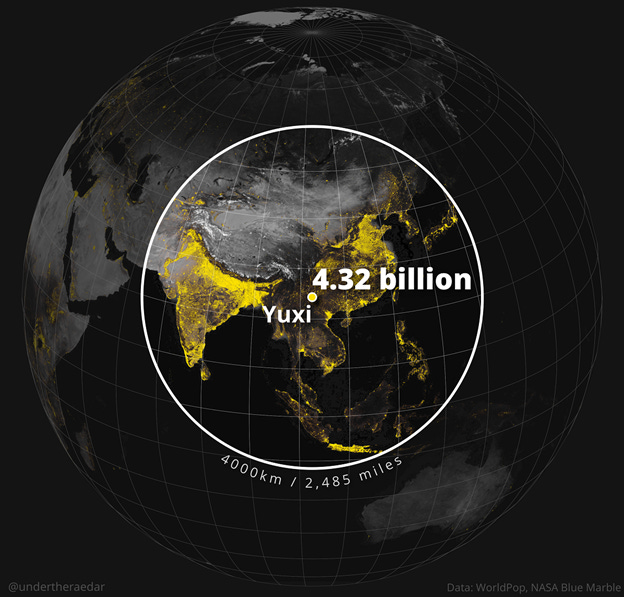

Here are a couple of graphics we’ve seen before. Yuxi, China is in Yunnan Province, and half the population of planet earth lives within a four-hour plane ride of Yuxi. And all these people are getting a lot more money to spend, and fast.

By 2030, these will be the world’s largest consumer markets. Asia is in red—double-digit gains everywhere except Japan. Europe is in blue, North America in green:

And there are the tabular data for the top 20, ranked by the size of the respective consumer markets five years from now: China at a billion plus. That 15% increase in China, by the way is the equivalent of adding two entire Germany’s worth of consumer demand in five years, and Germany isn’t going to grow at all.

Of all the countries here in the Top 20 that will grow by double-digits, Egypt is the only country not in Asia, the only country that isn’t inside the Yuxi Circle.

So for these German companies who are ignoring what their government is saying back home, it’s a simple matter of survival. Over four billion people are here, and they’re moving fast into the middle class. People in Asia are going to buy cars from someone, companies in Asia are going to buy chemicals from somewhere, and if the Germans go home, nobody here will even notice they’re gone.

Be Good.

**Resources and links:**Visual Capitalist, The Yuxi Circle: The World’s Most Densely Populated areahttps://www.visualcapitalist.com/cp/the-yuxi-circle-the-worlds-most-densely-populated-area/Bloomberg, Germany Is Just Making Too Much Money in China to Back Away nowhttps://www.bloomberg.com/news/articles/2025-11-16/germany-is-just-making-too-much-money-in-china-to-back-away-nowThe World’s Largest Consumer Markets in 2030https://www.visualcapitalist.com/the-worlds-largest-consumer-markets-in-2030

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed

It’s not just China, German companies have been buying up industry worldwide on a US style agenda of globalization with ended up killing off local industry and jobs. Half the world’s population is developing at a fast rate with a new middle class.