This is a transcript, for the video found here:

Bullets:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

DeepSeek and Qwen are rapidly gaining market share across the world. Their performance is roughly at parity with models from top US companies, at a fraction of the price.

But even large companies and government agencies are opting for Chinese AI systems, over models from US companies.

As tens of millions of enterprise users adopt Chinese LLM’s, the less power American companies will have in establishing global standards and protocols.

But this race is also one of semiconductors. Huawei’s networked chips perform far better running Artificial Intelligence systems, compared to systems that use Nvidia chips.

Nvidia’s stock price, however, reflects high investor confidence that Nvidia’s competitive advantages over other chipmakers are large, and durable, and further that it will be American LLM’s that will win the race for global AI supremacy. That thesis is now questionable.

Report:

Good morning.

Investors are looking at the semiconductor industry in the wrong way, and paying high premiums for shares of companies that are in big trouble in global markets, and in countries they’re not paying enough attention to. A year ago almost nobody had heard of DeepSeek, which is a Chinese large language model. But now DeepSeek and other Chinese LLM’s are strongly preferred to AI systems from US companies.

Amazon, Microsoft, and Google have operations across the world, and they have no choice but to offer DeepSeek to their customers outside the United States, because of the high demand for it. The reason is simple: Chinese artificial intelligence systems have performance that is about as good, but are far less expensive. China has advantages in two of the most important building blocks for AI: China has lots of data, and they have lots of smart people.

These are the top-performing AI models, from Chatbox Arena. Companies in red are from China, and Chinese firms hold four of the top 11 spots. Deepseek scored a 1424, while OpenAI—ChatGPT—got a 1428. So that is a negligible difference in performance, but DeepSeek costs 17 times less than comparable platforms built by US companies. That makes it a no-brainer for almost everyone who is allowed to install and use DeepSeek.

In Chile and Brazil, it’s appealing because of scarcity of computing power and budget restraints. But HSBC and Standard Chartered are some of the biggest banks in the world. Saudi Aramco has money gushing out of the ground, and they also opted for DeepSeek.

A key difference is here. Chinese companies develop AI to help users build applications quickly, and cheaply. Qwen is an open-source model from Alibaba, and developers have created over 100,000 derivative models. Remember here that Chinese AI apps are banned in the United States and Europe for government users, but developers in Japan are using them to generate data sets for government ministries there.

Outside the United States, then, acceptance is wide and deep for Chinese AI. DeepSeek is the most downloaded app in 156 countries. The largest markets for them are China, India, and Indonesia. Just those three countries add to over 3 billion people. And that’s a big part of the problem for US companies and investors. Country by country and user by user, the whole world is being put to a decision: American or Chinese AI systems.

The most important determination of who wins that race is not profits, or who can call up their governor and get it banned at a US state level. It’s a contest to win the markets of the world, because that will establish the protocols and technologies going forward. So the news is already bad, on that. Small businesses and content creators and developers are choosing Chinese AI because it offers them more flexibility for a lot less money. Asian banks, Saudi oil companies, and contractors for the government of Japan are choosing Chinese AI because it works better for them, even though money is no object.

It’s also here where we’ve got bad news for Nvidia. This company is now a $4 trillion company, by market cap. But Huawei’s chips perform better in AI applications than Nvidia. This global race that involves DeepSeek and Qwen versus OpenAI or Anthropic is also a chips race, and if Chinese AI sets the standard across the world, it’s companies like Huawei that builds the chips for it all.

Now, Nvidia still builds faster and better chips, on a unit basis, head-to-head. But Huawei’s chips operate together as systems, that are stronger than Nvidia’s systems. We won’t spend a lot of time on this report because after the first three paragraphs I didn’t understand a single word of the thing. But this analysis takes apart the system architectures of NVL-72, from Nvidia, and the Cloud Matrix 384 from Huawei. This also isn’t the most reader-friendly table we’ve ever seen. The scores for the individual chips come first. GB200 is from Nvidia, the Ascent 910C is from Huawei. On every metric there, Nvidia’s chip is better. Huawei vs Nvidia, and Huawei’s scores are 30%, 70%, a pair of 40 percents on these metrics.

At the system level though, it’s a different story. Suddenly Huawei is many times better, across the board. They explain it this way: Chinese advantages are at the system level, in networking, optics, and software.

Huawei is still a generation behind in chips, but when system architects scale them up and put them together, it’s Huawei that is a generation ahead. Huawei’s Ascend chip has one-third the performance of the Nvidia, so they just use more of them. That would be a serious obstacle in Western countries, where electricity is a lot more scarce and expensive, but in China it’s an afterthought. So the system capabilities for Huawei and China are superior to what Nvidia builds, and that’s right now.

Here’s the problem for investors. They have made an all-in bet that Nvidia would build chips and systems that outperform all the global peers, and that it would be American AI that would dominate the world and set the standard. That entire thesis is highly in doubt now. These are the numbers though. Nvidia shares keep hitting record highs, and the margins for Nvidia chips command the highest premiums in the industry. The gross margins on Nvidia sales are over 70%, and over half their revenues go to the bottom line as profits.

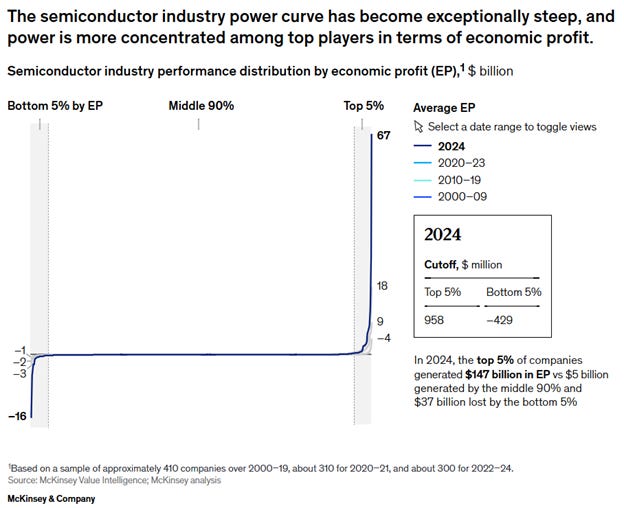

Nvidia shares are being priced by the markets as if the company were an extreme outlier, with deep competitive advantages that support high profit margins and stock price premiums that are durable long-term. But what if they aren’t? This is from McKinsey, and they note that just a small handful of companies are benefiting from the AI boom at all, and this is before DeepSeek and Qwen and Huawei decided to take over everywhere outside the United States and Europe.

Just 5% of the companies in the space generated all the industry profits last year. Nvidia is mentioned here, this group of companies that generated $159 billion in economic value—that is best expressed as Gross Margins, the ability of a company to capture a high premium over their costs. 90% of tech companies combined for only $5 billion in profits, with the rest losing big money.

This is a power curve, which demolishes the idea that investors can buy a mutual fund or ETF and diversify risk away or benefit from gains in obscure companies industrywide. There aren’t any—all of the money is being made by a tiny group of companies, and even in that group Nvidia is the elephant in the room.

It appears that the industry is in broad recovery since 2022, but if we back out Nvidia, the industry overall is in broad decline. That’s the light blue line, at 85% or so of the level from 2022 May.

The reason for that decline is China. The US had strict export bans on semiconductor sales to China, the objective of which was to destroy the chipmaking industry here. That went off the rails from the very beginning. Now China represents a record-high global market share for semiconductors and equipment, and McKinsey forecasts a 9% compound growth rate for Chinese domestic companies. And to repeat, that growth estimate was before Chinese AI models showed up, which run on Chinese chips.

Most companies outside China will struggle to grow, because of companies like Nvidia which are focused on AI, and because of China, whose companies operate at industrial scale. But now even Nvidia has an existential problem, because China’s at-scale companies just figured out how to build a better system.

This is the Huawei campus in Dongguan. Guangdong. Be Good.

Resources and links:

McKinsey, Silicon squeeze: AI’s impact on the semiconductor industry

SemiAnalysis, Huawei AI CloudMatrix 384 – China’s Answer to Nvidia GB200 NVL72

https://semianalysis.com/2025/04/16/huawei-ai-cloudmatrix-384-chinas-answer-to-nvidia-gb200-nvl72/

Reuters, Huawei shows off AI computing system to rival Nvidia’s top product

How Huawei’s Ascend AI chips outperform Nvidia processors in running DeepSeek’s R1 model

Wall Street Journal, China Is Quickly Eroding America’s Lead in the Global AI Race

https://www.wsj.com/tech/ai/artificial-intelligence-us-vs-china-03372176

DeepSeek AI Usage Stats

https://backlinko.com/deepseek-stats

Ranked: Semiconductor Production by Country or Region (1990-2032F)

https://www.visualcapitalist.com/semiconductor-production-by-country-or-region-1990-2032f/

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed