Bullets:

Just one year following China’s export restrictions on tungsten, prices have more than tripled, even in China.Defense contractors are scrambling for new sources of tungsten, a crucial component of munitions, missiles, and armored vehicles.But civilian users of the metal are also deeply impacted, as it is widely used in heavy manufacturing, automaking, and electronics.China is the world’s leading producer of tungsten, but also by far the world’s largest consumer of it. So while Chinese regulators are obviously concerned that their tungsten may be used by foreign militaries, the metal is also in high demand across China’s own industrial sectors.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

Just one year ago the Chinese government announced an export ban on tungsten, for any buyer who will use their tungsten to build weapons. That was an immediate problem for the Pentagon and for defense contractors, who need it to build advanced munitions, as well as regular explosives and armored vehicles.

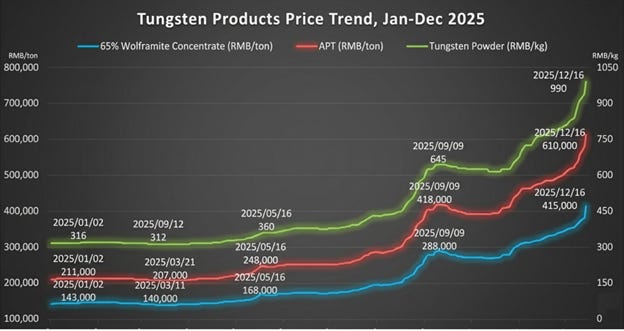

This is what has happened in global tungsten markets since—across the board, prices for the tungsten concentrates and compounds tripled in 2025.

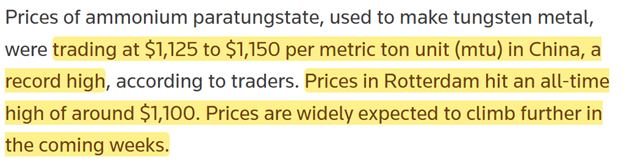

In 2026, it’s more of the same: prices in Europe and in China are at all-time highs, and will go higher. The primary uses are in cutting tools used for manufacturing and heavy industry, aerospace and defense, energy, and electronics. China’s exports of tungsten are down 40%. The rest of the world cannot make up for that loss of supply from China, who produces 67,000 tons a year, compared to just a few thousand tons from everywhere else.

A major challenge both for the Pentagon, and for tungsten consumers in civilian sectors, is that the metal is in high demand here, by Chinese factories. Notice here that the spot price for tungsten in Chinese markets is even higher than in Europe:

That won’t last — the Rotterdam price will go up faster than in China — but it shows what we’re seeing in other metals markets, in that tungsten suppliers — in this case — cannot respond to these higher prices by increasing output, the way that crude oil producers do, for example.

This problem is here to stay, in other words, and this feature from the Critical Minerals Institute is terrific. Two tungsten industry insiders explain how deep these problems go, and why.

For a long time, nobody cared about tungsten. Militaries who used tungsten had some domestic production of it, and there weren’t a lot of hot wars going on that burned up stockpiles. That’s not true anymore, and every time something blows up in Gaza or Ukraine it’s a call on tungsten miners to go and find more.

So now it’s a strategic material, and at the same time China closes it off to foreign militaries. That in itself if a problem for civilian users of tungsten, because it’s impossible for buyers—especially middleman buyers or traders—to prove to Chinese regulators who the end user is going to be.

And even with these big price moves, the problem isn’t that tungsten is more expensive. These industries are price-insensitive. The Pentagon, oil drillers, car factories—the price doesn’t matter; they’re paying. But NOT getting the tungsten is the issue now—it means things don’t get built at all, because there are no suppliers who can step up to replace China.

Almonty is a company who is reopening a tungsten mine in South Korea. They are looking at an 8-10 year wait just to get the permits. New players in tungsten mining are hard to find, because tungsten itself is so difficult to mine and process. It takes lots of time, lots of money, and lots of people with deep experience to do it. And so even in the countries that are friendly with the United States, there just aren’t new mines being opened.

Remember, the export bans from China were a year ago. And not much is happening on the supply side, and what is happening isn’t going fast enough. It will take years to get any new supply.

Once Chinse firms became the low-cost suppliers, they took over the industry. They did the same thing Western economies once did, building out value chains and taking market share, and in under a decade almost all the mines in the world outside China shut down.

China’s consumption of tungsten is the other elephant in the room. It’s what we have been insisting here on these channels for two years. The Chinese don’t want their rare earth metals to go to build rockets and missiles and bombs in other countries, obviously. But it also makes little sense for China to put its domestic industrial sector at a disadvantage by shipping these scarce materials to be used by factories in other countries.

China consumes half of all the tungsten produced in the world, as much as the rest of the world combined. Chinese demand for tungsten is four times that of the United States. So you could say that China is more motivated, then, to find new sources for tungsten, than the rest of the world combined, and much more motivated to keep the tungsten they do have for themselves.

Be Good.

Resources and links:China’s new export ban on tungsten shocks defense contractors as Pentagon races to find new supply

Tungsten Prices Hit Historic Highs, Opening a Strategic Window for vietnamhttps://masanhightechmaterials.com/tungsten-prices-hit-historic-highs-opening-a-strategic-window-for-vietnam/Tungsten surges to 12-year high as world enters a new ‘black gold’ racehttps://masanhightechmaterials.com/tungsten-surges-to-12-year-high-as-world-enters-a-new-black-gold-race/Why Tungsten Has Jumped to No. 1 on the World’s Critical Minerals Hot listhttps://investornews.com/critical-minerals-rare-earths/why-tungsten-has-jumped-to-no-1-on-the-worlds-critical-minerals-hot-list/Reuters, Tungsten rises to record highs as export curbs turn up supply heathttps://www.reuters.com/world/americas/tungsten-rises-record-highs-export-curbs-turn-up-supply-heat-2026-01-29/China Tungsten Market updatehttps://www.itia.info/assets/files/29AGM/5_China_Tungsten_Market_Update_Shi_Yusheng.pdfResearch Gate, Global tungsten production against proven reserveshttps://www.researchgate.net/figure/Global-tungsten-production-and-reserves-1000s-of-metric-tons-or-tonnes-by_fig1_395884060

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed