Bullets:

For over 40 years, the United States has enforced heavy economic and diplomatic sanctions against Iran.

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

But Iran’s energy sector is producing more crude and natural gas than ever, and exporting more than ever.

Huge investments in high-value-added condensates, LNG, and LPG are also paying off, and are exported to eager buyers all over the world.

China is a top buyer of Iranian crude, taking 90% of its crude exports. But Iran has recently passed Saudi Arabia, the UAE, and Qatar as the top producer and exporter of NG products, bringing in billions more.

Ambitious expansions of their petrochemical industry are also ongoing. Iranians report little difficulty in business operations among different currencies, despite the US Treasury Department’s blacklisting of key energy suppliers, and firm control over the SWIFT systems.

Report:

Good morning.

For over 40 years, Iran has been under heavy economic and political sanctions by the United States. Those sanctions are intended to disrupt the Iranian economy, by depriving Iran of export markets for their oil and natural gas.

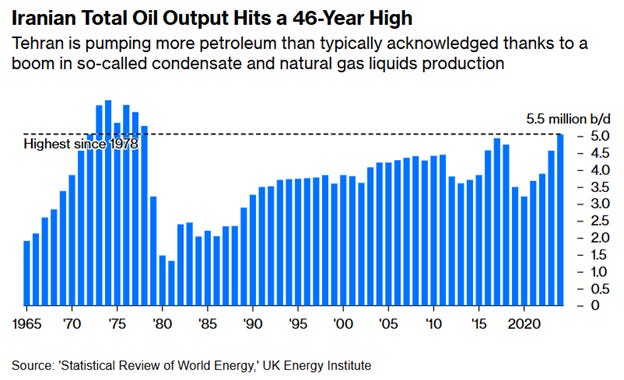

This is a chart of Iran oil production. Can you show me where and how well these heavy sanctions are working, exactly? Last year, Iranian oil production hit the highest level in 46 years. This analyst at Bloomberg is asking the same question we are, whenever he hears American policymakers talk about our sanctions on Iran. “What sanctions, exactly?” “Maximum pressure” on the Iranian oil sector means instead that Iran is producing more than ever.

Their export markets are booming, with the highest revenues in over a decade. In 2020, Iran exported $18 billion worth of energy products, and in 2024 it was $78 billion. What’s more, Iran is successfully diversifying their energy industry to higher-value-added products—condensates, and natural gas.

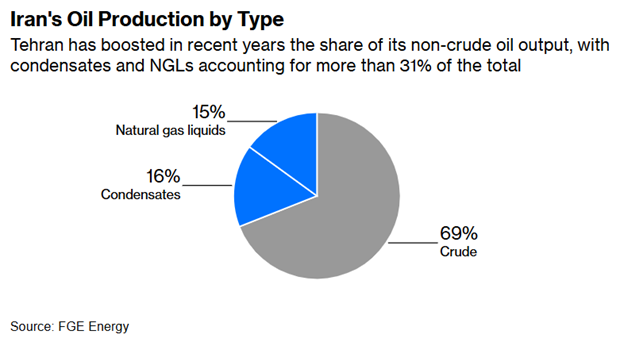

Now natural Gas Liquids are a major contributor to Iran’s economy, with propane exports at $3.6 billion, and another $2.2 from butane. Those niche markets are a strategic necessity for Iran, to increase foreign currency revenue. We’ll come back to that.

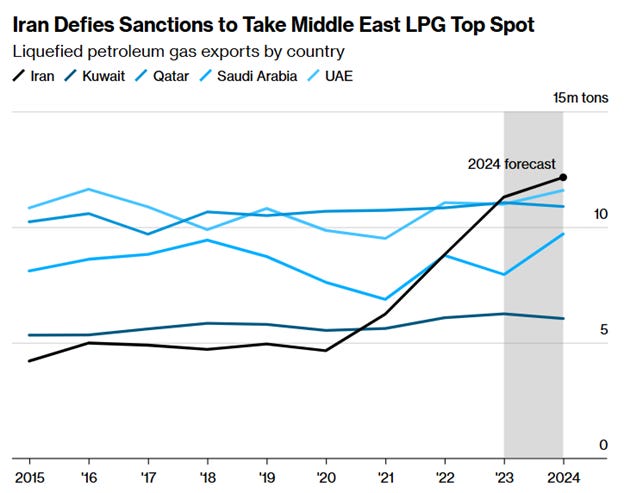

Iran is enjoying the same success in Liquefied Petroleum Gas. In 2015, their exports of LPG were ranked last among major Middle East producers, under 5 million tons a year.

Same question for this chart: “what sanctions, exactly?” Because last year Iran exported 12 million tons, and now is ahead of Saudi and the UAE, in first place. “Iran is defying US sanctions”; it’s the latest sign that the so-called “maximum pressure” from Washington isn’t making a difference at all.

Iran invested heavily in their diversification strategy, with plans to increase production to 200 million metric tons in the next 10 years. These are petrochemicals, not crude. So Iran makes more money on these exports. One hundred projects are coming, with a total investment of $70 billion.

In the short term, exports will rise more than 10%, and Russia is a key destination, along with – the entire rest of the world, may as well say—South America, Africa, Eastern Europe, and Asia. Iran has experienced some occasional issues in money transfers and foreign exchange, but nothing major. Nine companies in Iran were added to the blacklist by the Treasury Department, but the energy keeps going out, and revenues keep coming in.

Heavy sanctions are in place against Iran and they don’t matter. Bombs and missiles from Israel and the United States hit Iran and they don’t matter. The Iranians push the debris out of the way, and turn the pumps back on. 90% of their crude oil exports go to China, and none of that trade is affected by anything the Treasury Department can do.

We should be completely out of patience, by now, by anyone who pretends that major energy consumers and major energy producers who want to do business together, aren’t able to figure out a way to move their ships around, or send their money back and forth.

Resources and links:

Iran Defies US Sanctions With Surging Exports of Liquefied Petroleum Gas

Bloomberg, Iranian Oil Production Booms Amid the Bombs

S&P Global, Iran’s petrochemicals defy sanctions as exports, output on the rise

Iran announces 15 petrochemical projects to expand domestic production to nearly 80 MMtpy

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed