This is a transcript for the YouTube video found here:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

Bullets:

International companies with operations in China enjoy a key advantage in raising investment capital. They access China’s banks and bond markets and pay interest rates far below those on offer from North America or Europe.

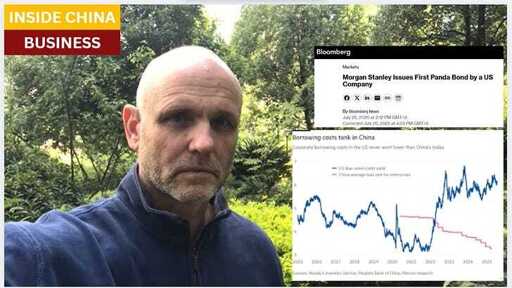

Morgan Stanley is the first US company to issue Panda Bonds, which are used by global companies to borrow from Chinese bond investors.

MS borrowed $280 million for 5 years, with a coupon of 1.98%, on an oversubscribed issue. Five-year notes with the same maturity in New York cost Morgan Stanley 4.6%.

National and provincial governments, other investment banks, and the top European automakers already are active in the Panda Bond market, and pay on average 1.93% rates for their five-year paper.

Report:

Good morning.

In China, interest rates are among the lowest in the world, and China’s government can borrow at rates less than half that of the United States.

This is right now, the market yields today on 10-year government debt. The 10-year Treasury is 4.314%, compared to China at 1.771%. So today, if the Chinese government wants to borrow another $10 billion dollars for 10 years, they will pay $177 million per year in interest. That same $10 billion borrowed by the US government will cost American taxpayers over $431 million per year, in interest.

As interest rates go up for governments, it costs taxpayers much more, each year. That’s a serious issue for the American government, and the Treasury Department is hoping to borrow at the short end of the curve, more money at shorter maturities, like for one year instead of ten, so the rate of interest is a little bit lower. That creates a host of other problems we’ll do another time. But our point here is that global capital markets are considering Chinese government paper to be safer, and more attractive on a risk/reward basis, than debt from the American government.

Corporate debt markets give us an even better perspective, because the issuer of the debt is one and the same. Morgan Stanley is a global investment bank. They operate all over the world, and MS borrows money all over the world. Last month Morgan Stanley became the first US company to issue Panda Bonds, in a deal worth 2 billion renminbi, which is about $280 million.

Panda bonds are denominated in renminbi, and overseas companies and banks who have established operations in China can use them to raise investment capital.

Here’s Bloomberg. In this paragraph, Morgan Stanley borrowed $280 million, for five years, with a coupon of 1.98%. That’s five basis points higher than the average of all corporate borrowers of Panda Bonds for five years. That means that, on average, issuers of Panda bonds pay 1.93% – 5 bps less than 1.98—for five-year money. One hundred basis points is one full percentage point.

We keep seeing words like “unexpected” and “surprising” in places like Bloomberg, where subscribers pay a lot of money to avoid being surprised. But they’re surprised that China’s debt markets are now seen by global investors as a safe haven. And there is also a lot of increased concern from investors toward the US debt and the US dollar.

Morgan Stanley is the first US company to issue panda bonds, but European carmakers are already very active here, using pandas to raise capital for their companies. Hungary, South Korea, Poland, Egypt and other government also use China to borrow money, along with banks.

Let’s go deeper. MS just borrowed for five years here in China, for 1.98%. So to compare apples and apples, we need to find what is costs Morgan Stanley to borrow money for five years in the United States.

So we need to sort these corporate bond tables here, by maturity, and look for MS bonds that mature in 2030, five years from now. And here those are—the first column is the effective market yield of MS bonds that will pay out in May of 2030. And for low-coupon bonds—the 2.25’s—it’s 4.6%, or 4.7%:

So to borrow capital in Mainland China, renminbi, to finance their operations here, Morgan Stanley pays 1.98% interest. To do the same in North America, their cost of capital is 4.6%–more than twice as much.

If you’re running an investment bank, or a big factory that makes cars, like Mercedes or BMW, or a small factory that makes tools—If you’re competing against banks or factories here in China that can borrow money for less than half what it costs your company, that is a big competitive advantage they’ve got, and you don’t.

Be Good.

Resources and links:

Morgan Stanley Issues First Panda Bond by a US Company

Bond Screener, Morgan Stanley

https://public.com/bonds/screener?issuerSymbol=MS

Morgan Stanley 5.173% 01/30 Bond

https://bondblox.com/bond-market/Morgan-Stanley-US61747YFK64

Fresh debt from JPMorgan, Morgan Stanley draws warm reception from investors in hopeful sign

Trump and Bessent Bring New Style to Managing America’s Debt

Global bond yields by country, 10-year maturities

https://tradingeconomics.com/bonds

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed