This is a transcript, for the YouTube video found here:

Bullets:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

The Houthis in Yemen are successfully targeting ships transiting the Red Sea and the Suez Canal, in protest of Israel’s military actions in Gaza.

Global shipping companies are routing shipping lanes between Europe and Asia around Africa, adding weeks of transit time, and far higher costs in fuel and crews.

But that means more time on the water, and fewer turnarounds. Container rates are rising even while trade with the US falls, and companies like Maersk are booking far higher profits than anyone forecast.

Chinese ships, however, are not going around Africa. The Chinese and Iranian governments very likely have an understanding that China’s ships will not be attacked. That translates into substantial cost savings for the shipping companies, and the customers of Chinese products.

Report:

Good morning.

For much of the world, sending cargo ships through the Red Sea and the Suez Canal is a big risk. Any ship going through the Suez passes near Yemen, and is in range of Houthi rockets and drones. On 28 July, the Houthis announced new efforts, an intensification of their campaign to attack ships going through the Suez, in protest of Israeli military actions in Gaza.

The Houthis are successfully targeting shipping and crews. The Eternity C was a Greek vessel, sunk, and in the same week the Houthis forced the crew of another, the Magic Seas, to abandon ship. The Eternity C was headed for an Israeli port, according to the Houthis. The Galaxy Leader was another.

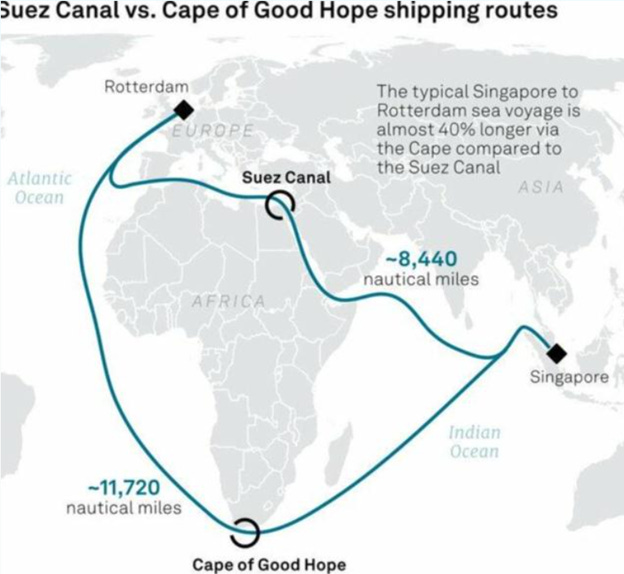

Shipping companies going back and forth from Europe to Asia face a stark choice—take their chances and go through the Red Sea and Suez, or go around Africa. Singapore to Rotterdam through the Suez is 8,440 miles, and going around Africa it’s 40% longer, at 11,720 miles:

That’s a lot more time, a lot more fuel, and a lot more expensive. But the decision is costly either way—pay a lot more in fuel and shipping charges, or pay a lot more in cargo insurance to send it through the Suez, and doing so means your cargo may not arrive at all–losses may be total—if anything on the boat is going to or from Israel.

Naturally, then, they’re going around, paying up for fuel and crews and time, and that means higher profits for the ship operators. Maersk is one of the top shipping companies in the world, and they forecast higher profits because of the higher freight rates they collect from sailing around the Red Sea. They expect Houthis’ attacks on vessels through the Suez to last at least through the end of 2025.

Maersk and other ocean freight companies have been shifting routes around Africa since December of last year, and this adjustment in routes is fixed; “more or less permanent”. But that means more money. Maersk’s profits were $70 million higher than analysts expected for the first quarter. Sydbank’s analyst says the shippers are “getting help from the Red Sea”, but when the situation in the Suez changes and ships can go through there safely again, profit margins will come under pressure.

So shipping companies are making more money, because the freight is on the ocean for longer. What’s more, shipping container demand stacks up, because it takes ten days longer to sail around the Suez, compared to sailing through. That means fewer turnarounds per year. If demand for shipping containers holds steady, prices go up, because there is a lot less loading and unloading.

Everyone in Europe is seeing big cost increases for inbound shipping, then, no matter where from. And the freight takes longer to arrive, and arrives less often because ships are taking on average 40% longer to make the trips back and forth between Europe and Asia. The shipping companies are happy about it all, because they’re making more money for doing less work, by sailing around Africa.

But Chinese shippers aren’t going around Africa. That is a car carrier from BYD, a Chinese carmaker, and they’re sending those right past Yemen, and through the Suez. Ships for other car companies are going around. Last month at least fourteen of those car carriers went from China to Europe, through the Suez. Same number as in June. That’s a story right there, that fourteen of those giant things are going to Europe every month, full of cars. BYD and other carmakers in China use these ships, with twelve decks and capacity for 5,000 cars, worth a total of $100 million. That’s $20,000 per car, which is yet another stand-alone story, that new Chinese cars coming into Europe cost a lot less then ones coming out of car factories in Europe. So 5,000 cars times fourteen ships a month is 70,000 cars, per month, going from China to Europe, through the Suez Canal.

The Houthis use drones, drone boats, grenades, and rockets to attack ships sailing by. Maersk and the other shippers then are prudently avoiding the area and going around Africa, and making more money doing so. But these big Chinese ships are being waved right through. Shipping experts conclude that China’s government has an understanding with Iran and the Houthis that their ships will not be attacked.

In the case of China’s car carriers, here’s what that translates to: going through the Suez saves at least two weeks of shipping time, along with the higher costs for fuel and crews. On each car, that represents a savings of $200. Those lower costs help Chinese companies compete against cars coming from Japan, Korea, and Europe.

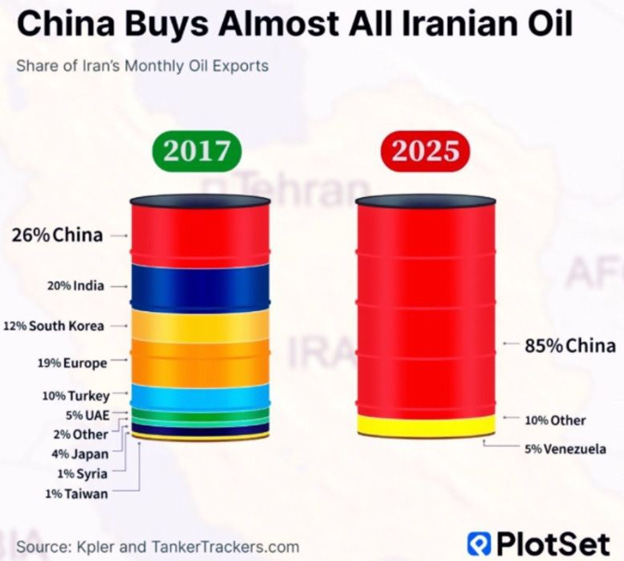

China buys a lot of Iranian oil. The boycotts that are in place by Western countries were never ratified by the UN, so they are not legally binding on Chinese oil companies. Summing up: Iran sells a lot of oil to China, so they call their friends in Yemen and tell them that if they see a ship with a Chinese flag on it, to leave it alone. Then anyone in Europe who buys a Chinese car gets it faster and cheaper than one coming over from Korea or Japan.

Everything happening here should be a big surprise, anyway. The United States was bombing the Houthis for months, to keep shipping lanes open through the Red Sea and the Suez. A ceasefire was announced in May, and the US Navy pulled out of the area. Trump said that the United States would stop attacking the Houthis, who “capitulated.” The ceasefire was brokered by Oman, whose foreign minister said that “freedom of navigation and the smooth flow of international commercial shipping” was ensured. A “Massive Win”, said the White House Press Secretary. “Great American strength”, which ”swiftly delivered on the promise” to restore freedom of navigation in the Red Sea.

Technically, this is mostly right. But it is Chinese ships have freedom of navigation in the Red Sea. And the Chinese seem to have it all to themselves, because the Houthis are still making Maersk and the other shippers go around. But they aren’t complaining—they’re making more money than anyone thought possible.

Be Good.

Resources and links:

China buys almost all of Iran’s oil

BBC, Trump says US to stop attacking Houthis in Yemen as group has ‘capitulated’

https://www.bbc.com/news/articles/c5y5yd08wy7o

Bloomberg, Houthis to Step Up Shipping Attacks to Press Israel on Gaza

New York Times, Satellite Imagery Shows Ship Hijacked by Houthis Near Yemen Port

https://www.nytimes.com/2023/11/21/world/middleeast/houthi-hijack-ship-galaxy-leader.html

NYT, Four More Rescued in Red Sea, as Houthis Vow to Keep Up Attacks

https://www.nytimes.com/2025/07/10/world/middleeast/houthis-attack-crew-rescued.html

Reuters, Maersk raises profit guidance on strong demand and Red Sea disruption

NYT, China’s Automakers Are Taking a Shortcut to European Markets

https://www.nytimes.com/2025/08/11/business/china-electric-vehicles-red-sea.html

Reuters, Maersk boosts profit outlook as container demand defies trade fears

Increasing new car prices for European fleets

https://www.activacontracts.co.uk/news/increasing-new-car-prices-for-european-fleets.html

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed