This is a transcript, for the YouTube video found here:

Bullets:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

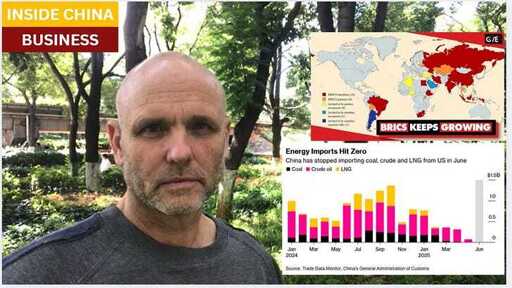

In June, US energy exports to China collapsed to zero in crude oil, coal, and liquefied natural gas.

That followed a similar plunge in exports of liquefied petroleum gases and propane.

Key BRICS members Russia and Iran have stepped in, and along with other Middle East trade partners easily supply China with energy previously sourced from US markets.

Report:

Good morning. China has already decoupled from the United States for agricultural products, which is hurting American farmers who were dependent on exports to China, who is now well supplied by Russia and Brazil.

We’re seeing now the same decoupling in energy, as China has developed new sources of supply from Russia and Iran.

This is from April. Propane is a liquefied petroleum gas, and China used to be one of the biggest buyers of US propane, after only Japan. Suddenly, China stopped buying it, and the price collapsed by over 30% in a single month:

This had been an important export for American energy producers, especially in the shale patch. And China was a huge buyer of propane and other LPG, mostly for its plastics industry. The bilateral trade in LPG was running about $1 billion a month, and 60% of China’s LPG was US-sourced.

But then the tariffs came, from both sides. At the time, the retaliatory tariffs on US exports to China were 125%. Those didn’t last for long, but they were long enough. Chinese buyers rushed to find other sources, and they found supplies elsewhere. Chinese plants stood to lose $770 a ton on American propane, but by switching to Middle East suppliers, they could stay in business.

So much of the trade between China and its suppliers now is outside Western systems, that we can only guess how China’s demand is being met, by whom, and at what prices. We do know that the US was China’s biggest supplier of propane, then suddenly China wasn’t buying any at all. We safely assume that Iran stepped up, because in the April-May period earlier this year liquefied propane was Teheran’s largest non-oil export.

American policymakers also assumed that, and took “massive action” against Iranian sales of LPG, after the collapse in US exports. The goal of those efforts is to “exert pressure on a sector involved in significant exports to China.” These are the press releases from State and Treasury, but analysts are skeptical the shippers can even be sanctioned at all, let alone that the new trade routes from Iran to China will be disrupted.

That’s propane and other LPG—liquefied petroleum gas. Now bad news is hitting other energy market sectors. Crude oil, Liquefied Natural Gas, and coal exports from the United States to China went basically to zero in June. China’s tariffs on these products were lower than for LPG—just 10-15%, but those were high enough to push Chinese buyers to source from elsewhere. China is the world’s biggest buyer of crude oil, and in June 2024, China bought $800 million of crude from US suppliers.

In June 2025, that number is zero. Last month, US sales to China for gas was also zero. and for the fourth month in a row. In June of last year China bought $90 million worth of US coal, now it’s next to nothing there.

China has diversified its commodities imports, Russia and Saudi are big players for crude, and Russia again for natural gas.

The trade wars have done a lot of damage in a short time, to American farms exporters of soybeans and corn. Now the same is happening in energy, a decoupling of American suppliers from Chinese demand. We believed—very wrongly—that because China had always bought our soybeans and our energy, that they always would. That chart is almost impossible to believe: October 2024 wasn’t that long ago, and we probably thought that China was dependent on us for their supplies of coal, crude, and LNG. We thought they needed our LPG else their plastics industry would go out of business.

So our political leadership needs a new perspective, and fast, on the BRICS trading bloc. The BRICS are natural resources economies, and producer economies. Taken together, the countries on this map pull easily enough energy out of the ground to keep their lights on and their cars moving. They easily grow enough food to keep everyone fed.

And then there is China, the world’s biggest manufacturer, by far. And the BRICS countries pull enough ores and metals out of the ground to send to China, who can build everything they need.

Resources and links:

Sanctioning a Liquified Petroleum Gas Shipping Network to Further Pressure Iran

US Targets Iran’s LPG Trade with Sanctions After Failed US Export Effort

Bloomberg, China’s Key US Energy Imports Near Zero Before Vital Trade Talks

Liquefied propane, natural gas major non-oil exported products in 2 months

US targets Iran’s LPG exports pre-nuclear talks

China’s Key US Energy Imports Near Zero Before Vital Trade Talks

China’s Fossil Fuel Imports from US Tank before Trade Talks

Bloomberg, China’s US Decoupling Collapses Trade in Key Petroleum Product

https://home.treasury.gov/news/press-releases/sb0215

Higher Tariffs Here to Stay Despite Trade War De-Escalation?

https://www.statista.com/chart/34447/additional-tariffs-by-the-us-on-china-and-vice-versa-2025/

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed