This is a transcript, for the video found here:

Bullets:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

China is famously a large seller of US government debts. Lately they are joined by India, Brazil, and Saudi Arabia.

Meanwhile, Israel has sharply ramped up buying US Treasuries, despite massive fiscal outlays for their wars against Iran and in Gaza. The UK, France, and Japan were also big buyers over the past year.

China and India run very large trade surpluses with the United States. Historically these surpluses would be reinvested into the American economy. But they are instead buying gold and bringing it back to Asia vaults, or moving their dollars to banks outside Western banking systems.

Can the most friendly governments continue to fund the giant US fiscal deficits, given increasing financial strains in their own economies?

Report:

Good morning.

This table is from a report in Times of India, where India’s central bank is selling US Treasury bonds and buying gold instead. From June of last year to this June, India sold $14 billion worth of Treasury bonds. What we want to look at today is the other countries on this chart. The ones that are closer to China, diplomatically, are all selling Treasury’s. We’ve talked about China’s selling US government bonds before. But now they have company: India down. Brazil down. Saudi down.

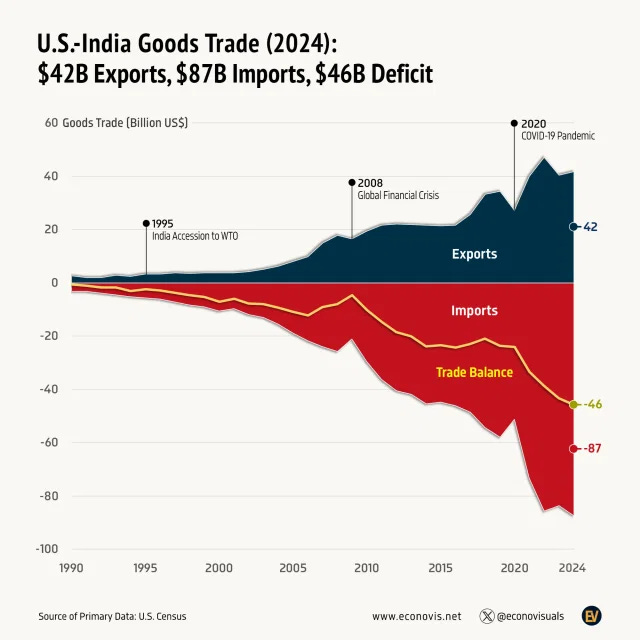

India is a major seller, even though India runs large trade surpluses with the United States. The US trade deficit with India is the tenth largest of all the trading partners, and that is growing over time:

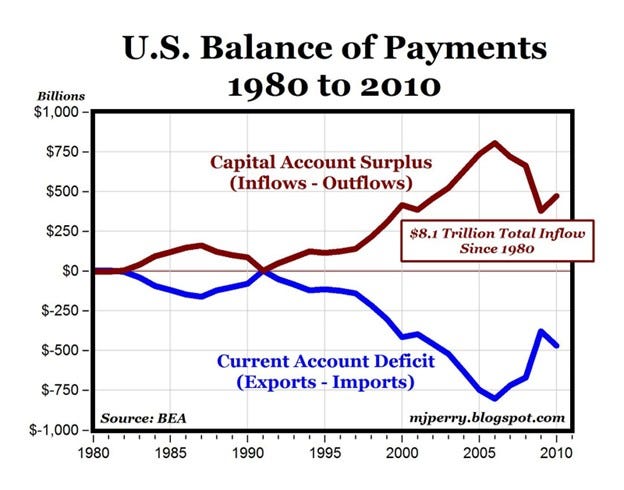

It is only in very recent years this was even possible. This chart below is in all the Macroeconomics textbooks in the world, and explains Balance of Payments. Trade deficits are the same as capital account surplus, because deficits that the United States, in this case, runs for trade, results in surpluses in capital invested back into the United States. The Balance of Payments always equals zero. So from 1980 through 2011, the US economy benefited by more than $8 trillion, from that $8 trillion worth of trade deficits being reinvested back into the United States.

But this is from 2011, and presupposed a global system—one system—of banking and finance and trade. The BRICS countries are building a new one. China and India—along with Vietnam, we could say—they are happy to take our dollars, and not invest them back. We’re not sure what they’re doing with them—a lot of it is to buy gold in Western countries, to be hauled out of vaults in the US and Europe and sent to vaults in Asia. And there are also giant piles of dollars and Euro being moved here, to capitalize the new financial centers in Hong Kong and in the Middle East, collateralizing trade using their own banks instead of ours.

Another feature that stands out here, is that the most friendly countries to the United States are doing a lot more buying, and more than enough – so far – to offset the selling from China, India, and Saudi. Japan bought $56 billion more, but they may be done buying for a while. The UK bought $112 billion more Treasury’s since last June. France up $70 billion. Israel on a percentage basis saw the biggest jump of all, that $32 billion increase is a 46% rise in their holdings in one year.

And all of those countries have been buying at a time when the fiscal situation in their own countries is deteriorating. The current French government isn’t likely to make it another two months, because of the debt problems there and no good choices to deal with them. It costs the French government more to borrow money than it costs the Greek government to borrow, and even the Greeks are more frugal than the Americans these days.

The UK has the same problem; worries are mounting there about the government’s finances. Government borrowing costs are the highest level in 27 years, and growing faster than any other G7 country. But it’s not like the others aren’t trying—government bonds in Germany, France, and the Netherlands are at the highest rates since 2011.

In Israel, they need new borrowings to cover the cost of their wars against Iran and in Gaza. There are big budget increases for the IDF to “continue intense military operations until the end” of the year, and extra set aside for an eventual occupation of Gaza.

[In Japan—more of the same.](https://money.usnews.com/investing/news/articles/2025-08-31/japans-fy2026-spending- requests-to-set-record-for-third-consecutive-year-draft-shows) Record overall spending, record healthcare spending, record interest payments, record spending on defense.

Our larger point here is that at the same time the United States needs to roll over a tsunami of debt, and borrow $2 to $3 trillion more just to keep the lights on at the Pentagon, the biggest buyers of our Treasury debt have big problems of their own. And countries with some of the biggest trade surpluses with the United States—China and India, are just taking the dollars—out of our banks, out of our system, and out of this entire economic model that did govern the economy of the whole world, until very recently.

We’re in a world today that nobody thought could exist, but does. The government of Greece is considered more credit-worthy than that the United States and most of the rest of Europe. China can lend dollars—United States dollars—to their allies and trading partners at lower rates than the United States government itself can get. The economic sanctions against Russia made them stronger instead, and incentivized instead the construction of a new economic system. None of these things were supposed to be possible. But here we are.

If you’re living in a country on this map that is either red or orange, your government is still making lots and lots of dollars, and bringing them back home as fast as it can. And if you live in a country that’s gray, your government is probably broke.

Be good.

Resources and links:

$9 trillion of US debt will mature in 2025; Should investors be worried?

https://finbold.com/9-trillion-of-us-debt-will-mature-in-2025-should-investors-be-worried/

New York Times, Japan’s Debt, Now Twice the Size of Its Economy, Forces Hard Choices

https://www.nytimes.com/2025/05/28/business/japan-debt.html

Japan Eyes Record Spending Requests on Rising Debt, Social Welfare Costs

https://money.usnews.com/investing/news/articles/2025-08-31/japans-fy2026-spending-

requests-to-set-record-for-third-consecutive-year-draft-shows

Israel to widen fiscal deficit target to fund war

https://en.globes.co.il/en/article-israel-to-widen-fiscal-deficit-target-to-fund-war-1001519250

UK borrowing costs rise at fastest pace in G7

https://www.telegraph.co.uk/business/2025/09/01/uk-borrowing-costs-rise-at-fastest-pace-in-g7/

UK borrowing costs hit 27-year high adding to pressure on Reeves

https://www.bbc.com/news/articles/cy989njnq2wo

Why is France’s government on the brink of collapse, again

https://www.aljazeera.com/economy/2025/9/2/why-is-frances-government-on-the-brink-of-collapse-again

France’s government is on the brink of collapse - and could be facing a staggering debt crisis

LinkedIn, US rising trade deficit with India

Another Name for “Trade Deficit” Is “Capital Account Surplus,” Balance of Payments Always = 0

India’s holdings of US Treasury’s fall as gold holdings rise

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed