This story was originally published by Popular Information, a substack publication to which you can subscribe here.

Last week, Treasury Secretary Scott Bessent announced a $20 billion package to rescue the Argentinian economy. The risky taxpayer-financed deal, which involves trading US dollars for Argentine pesos, has little upside for ordinary Americans. Argentina is not a significant US trading partner, and its economy, long in turmoil, has little impact on the United States.

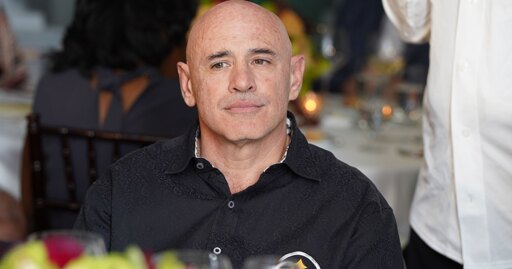

However, Bessent’s announcement had massive economic benefits for one American: billionaire hedge fund manager Rob Citrone, who has placed large bets on the future of the Argentine economy. Citrone, the co-founder of Discovery Capital Management, is also a friend and former colleague of Bessent—a fact that has not been previously reported in US media outlets. Citrone, by his own account, helped make Bessent very wealthy.

Since Javier Milei, a right-wing populist, became president of Argentina in December 2023, Citrone has invested heavily in Argentina. Citrone has bought Argentine debt and purchased equity in numerous Argentine companies that are closely tied to the performance of the overall economy. Due to Argentina’s massive debt load and chaotic economic history—in 2023, Argentina’s inflation rate was over 200 percent—Citrone purchased Argentine bonds with an interest rate of nearly 20 percent. (Citrone has declined to detail exactly “how much of the $2.8 billion he manages is invested” in Argentina.)

In early September, days before Bessent’s bailout announcement, Citrone purchased more Argentine bonds.

Citrone, who is also a minority owner of the Pittsburgh Steelers, is effectively betting on Milei’s right-wing economic program, which emphasizes deregulation and sharply reduced government spending. Citrone viewed “the probability of default as minuscule,” even though Argentina has defaulted on its debts many times in the past.

In the short term, this appeared to be a savvy investment. After taking office, Milei fired tens of thousands of government workers, cut spending on welfare and research, and achieved fiscal balance. Inflation was reduced to around 40 percent, which spurred economic growth and foreign investment. Argentina’s economic rebound contributed to Discovery Capital’s 52 percent return in 2024.

Then it all came crashing down.

The austerity measures slowed economic growth, and unemployment spiked to nearly 8 percent. Millions had a harder time making ends meet after Milei reduced or eliminated subsidies for transportation, medicine, and other necessities. Milei’s popularity slumped, leading to speculation that his party could be routed in the 2025 midterm elections, which would hamstring Milei’s ability to implement his agenda. This created an economic panic, with investors dumping the peso and liquidating other Argentine assets.

Milei has desperately attempted to keep inflation in check. Last week Argentina’s “central bank spent more than $1 billion to shore up the peso.” But Argentina was running out of foreign currency. That spelled trouble for Citrone.

Then Bessent and the Trump administration came to the rescue, floating a $20 billion economic package that helped stabilize the Argentine peso and functioned as a political lifeline for Milei.

In early September, days before Bessent’s announcement, Citrone purchased more Argentine bonds.

Bessent’s personal and professional relationship with Citrone has spanned decades. In a May 14 appearance on the “Goldman Sachs Exchanges” podcast, Citrone revealed how he delivered a financial windfall for Bessent. They were both working for investor George Soros in 2013 when Citrone convinced Bessent and Soros to bet on the US dollar against the Japanese yen.

I think there’s special times every five or ten years where there’s a really spectacular trade in investment that we then will concentrate in a meaningful way. 2013, the dollar-yen, where we made over a billion dollars long dollar-yen. And, in fact, you know, we discussed it quite a bit with George, and I kind of convinced George and Scott Bessent at the time to go big in that. And, you know, Scott says I’m responsible for 75 percent of his bonus at Soros, kind of jokingly, over that time.

CE Noticias Financieras, a leading Latin American economic publication, describes Citrone as “a friend of the Secretary of the Treasury.” El Cronista, citing government sources, reported that Citrone “has a personal relationship as well as a past working relationship” with Bessent.

Citrone has also reportedly leveraged his relationship with Bessent to gain access to Trump. According to CE Noticias Financieras, in November, “Citrone gave a case of four red wines to Javier Milei during his visit to Mar-A-Lago, in Palm Beach, in his first meeting with Trump.”

When Argentina’s economy began to falter in April, it was Citrone who “intervened before Scott Bessent…to advocate for an IMF agreement with Argentina,” CE Noticias Financieras reported. Bessent subsequently played a key role in convincing the IMF to extend a separate $20 billion currency stabilization package. (That package ultimately proved insufficient to stabilize the Argentine peso.)

Shortly after the IMF deal was secured, Bessent traveled to Argentina to meet with Milei and other top Argentine officials. It was an unusual choice for the Treasury Secretary’s first foreign trip. Citrone arrived in Argentina at the same time as Bessent, meeting with Milei just before Bessent. During those meetings, Bessent emphasized US support for Argentina’s economic agenda.

Bessent’s September 24 announcement, thus far, has had the desired impact, increasing the value of Argentine assets, including bonds, stocks, and the peso. “It has helped tremendously that the US has come in to support Milei, and it will pay dividends for the US strategically,” Citrone said in an interview with Bloomberg.

Whether the US improves the prospects over the long term is a separate question. Propping up the value of the Argentine currency beyond what the market will support with yet another influx of foreign currency gives wealthy Argentines an opportunity to cash out. The Argentine elite now have the ability to convert their peso assets into dollars and move them abroad. This phenomenon, known as “capital flight,” is why the previous IMF bailout package proved insufficient.

Discovery Capital did not immediately return a request for comment about Citrone’s role in securing the US assistance package for Argentina.

Another overlooked aspect of the rescue package is the role of the organizers of the Conservative Political Action Conference (CPAC), an influential right-wing political group.

In November 2024, shortly after Trump’s election, key CPAC officials, including Matt Schlapp and Mercedes Schlapp, founded a new lobbying firm called Tactic Global. This is the same group that organized CPAC Argentina in December 2024, an event that featured Milei, Lara Trump, and other right-wing luminaries. CPAC has long played a key role in Trump’s political operation.

In February 2025, Tactic Global began representing the Argentine government as a foreign agent. According to the filing, “Tactic will serve as a liason [sic] between Presidencia de la Nacion de la Republica Argentina and its counterparts in the U.S. Tactic will coordinate meetings between officials of the two countries and offer strategic counsel to the Secretaria de Inteligencia de Estado.”

The contract specifies that Argentina pays Tactic $10,000 per month.

Tactic Global’s official name is Tactic COC because its parent company is COC Global Enterprise. Leonardo Scaturice, an Argentinian businessman and lobbyist who lives in the United States, is the chairman and CEO of COC Global Enterprise and a principal at Tactic Global.

In April 2025, Matt Schlapp traveled with Citrone to meet with Milei and other top Argentine officials, according to news reports. They arrived together in Scaturice’s private jet, a striking black Bombardier Global 5000. Also participating in the meetings was Soledad Cedro, the Managing Director of Tactic Global and the CEO of CPAC Latin America.

Scaturice once worked for Argentine intelligence, which may explain why Tactic Global’s contract was routed through the Argentine Secretariat of Intelligence. More recently, CE Noticias Financieras reported that Barry Bennett, a former Trump advisor and current Tactic Global principal, “became directly involved” in securing the US rescue package.

Although CPAC promotes itself as an “America First” organization, Tactic Global represents not only the government of Argentina but also Kyrgyzstan and Vietnam. After Bessent announced his rescue package for Argentina last week, CPAC promoted the deal on its social media accounts.

From Mother Jones via this RSS feed