This is a transcript, for the YouTube video here:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

Bullets:

After a slight dip in outbound investment in China’s Belt and Road Initiative in 2020-2022, leading Washington think tanks declared that the program had been a failure.

But the program had merely shifted, to different regions, and to investments higher up the value chain.

In the first half of 2025, Chinese BRI investments are again at record levels, and are diversified across manufacturing, high technology, energy, mining, and transportation.

Cumulatively, China has invested over $1.3 trillion into developing economies in the past twelve years.

Those investments have profound impacts for global trade and diplomacy, and conferred on China deep and enduring advantages.

Report:

Good morning.

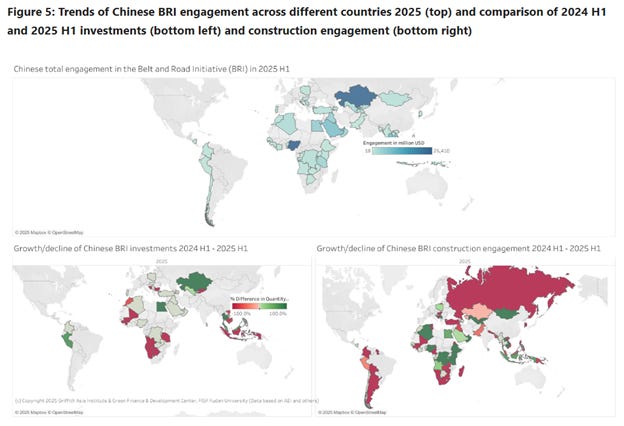

China’s Belt and Road Initiative is probably the most consequential economic and diplomatic project ever, in human history. And we’ll kick off with this, which is an update over the first six months of 2025. It shows that over the first half of the year, Belt and Road investments were the highest for any six month period, ever.

In energy, it was up over 100% compared to last year’s first half. Oil and gas from January through June was over $30 billion, which is higher that all of last year. A third of that was in Nigeria.

New records also hit for green energy, about 10 billion dollars’ worth, with nearly 12 gigawatts of new power installed. Lots of new investment in coal.

New records also set in metals and mining, technology, and in manufacturing. Top regions were Africa and Central Asia.

The Belt and Road is 12 years old this year, and cumulative investment to date is $1.3 trillion. And there is the chart that shows investments—this is by year, and by sector. So there has been a steep rise in outbound Chinese infrastructure investments since 2020 and 2021.

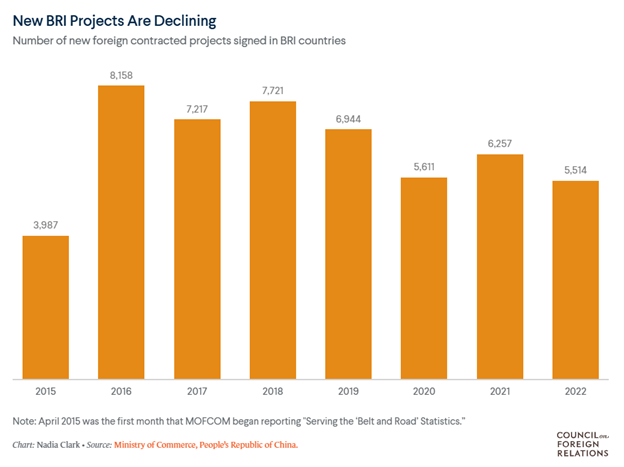

And that dip between 2020 and 2022 led our own policy analysts and think tanks to draw conclusions that turned out to be wrong. Obviously it was temporary, but at the time our top people thought the downward trend would continue. The Council on Foreign Relations published this piece in April of 2023, “The Rise and Fall of the BRI”.

They noted that number of new projects was in decline, and that the value of them was also declining. The Council on Foreign Relations is a think tank, and it is comprised of deep Washington and establishment insiders, specializing in American foreign policy and global affairs. Its chairman is the founder of Carlyle Group, regent at Smithsonian, chairman of Brookings Institution, and president of the Economic Club of Washington, trustee of the World Economic Forum and was an assistant to President Carter.

The president of CFR was a US Trade Representative for Obama and a deputy national security advisor. The board of directors include former Cabinet Secretaries, investment bank heads, superrich widows, news anchors. So the Council on Foreign Relations is as Establishment Washington as can be, and they were telling everyone that the Belt and Road was over in 2023.

This one is from FDD, the Foundation for Defense of Democracies. Their report is from about the same time, with about the same conclusion—China’s BRI is either cutting way back or falling apart completely. This Foundation is a pro-Israel, anti-Iran lobbying group formed to provide education that helps Israel’s image in North America. They are registered lobbyists, and top politicians in the United States contribute to the FDD also, especially if they’re running for President.

And this was their assessment: the BRI has failed to live up to China’s goals, and burdened developing economies with high debt and non-productive assets.

We have done about a dozen reports so far, where the reality is the total opposite. China trade with Africa is booming, and especially in high-value-added goods, because of the infrastructure projects that have come fully online there. New ports in South America are transforming supply chains and putting North American farmers out of business.

So this report is even worse than the first:

“The BRI has been a victim of opacity and lack of centralized coordination. Beijing unleased a funding bonanza but without a centralized function that would ensure the money was well used. “

We’ll stop there and just ask, does that sound anything like what your understanding of China is? Whatever your feelings about China generally, don’t we all kinda know that everything here is carefully planned and coordinated? I’ll tell you from my own experience, that if your company proposes a project that will involve any Chinese public money—the people’s money; and that is what they call it—you’ve just signed up for endless meetings and audits and forms and levels of oversight and supervision. Through it all is the understanding that if any of that people’s money goes missing, we’re all going to jail until it’s found. The whole process is designed to make you want to kill yourself for ever thinking it was a good idea in the first place.

But it’s the same thing every time. Our top experts look at a graph—this one, and make wild assumptions about what might be driving a drop, and conclude that it must be that Beijing officials gave away over a trillion dollars and don’t know where it is. It’s amazing this thing was published. A big Chinese infrastructure investment might work out, or it might not, but it will never ever suffer from a “lack of centralized coordination.”

So here’s what is happening, instead. The BRI was so successful that it expanded. Here’s a map of where: the entire Pacific Coast of South America, so their ships don’t have to go through the Panama Canal anymore. Africa. Eastern Europe. Central Asia. New Chinese construction spend is rising again, and on a per-project basis are at the highest level ever. Overall Chinese investment, new record, new record highs for average project value.

China’s total investment—cumulative—on Belt and Road Initiative projects now stands at $1.3 trillion. That’s over a total of 12 years. That is slightly higher than China’s trade surpluses, with the rest of the world, for a single year. That figure is also slightly higher than what the United States spends on defense and weapons systems.

Again, whatever your feelings are about China, who do you think is getting more value from this spending? The Pentagon in a single year, or China after all these BRI projects over the course of 12 years? Because it’s the BRI that made these data possible. It explains why this world map flipped from blue to red, and that now most of the countries in the world do much more business with China, than with the United States. It explains the news that Chinese companies are easily replacing their American consumer markets with new buyers from South America, Africa—everywhere else, really. It explains why every time there is a BRICS summit, new countries want to sign up.

These trillion dollars went a long way; changed literally everything. And two years ago our top people really believed they had turned the thing off.

Resources and links:

Bloomberg, China Pours Exports Into Africa Faster Than Anywhere Else

China Belt and Road Initiative (BRI) Investment Report 2025 H1

https://blogs.griffith.edu.au/asiainsights/china-belt-and-road-initiative-bri-investment-report-2025

Tightening the Belt or End of the Road? China’s BRI at 10

https://www.fdd.org/analysis/2024/02/27/tightening-the-belt-or-end-of-the-road-chinas-bri-at-10/

https://www.opensecrets.org/orgs/foundation-for-defense-of-democracies/summary?id=D000072176

https://en.wikipedia.org/wiki/Foundation/_for/_Defense/_of/_Democracies

Council on Foreign Relations, The Rise and Fall of the BRI

https://www.cfr.org/blog/rise-and-fall-bri

Council on Foreign Relations (CFR)

https://www.influencewatch.org/non-profit/council-on-foreign-relations-cfr/

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed