Bullets:

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

Last year, Brazil passed the United States to be the world’s number one exporter of cotton.

China is Brazil’s biggest buyer, taking more than half of Brazil’s cotton crops.

Brazil’s cotton exports to China were up a stunning 14 times in a single year.

American cotton farmers are being wiped out by soaring input prices. Fertilizer costs are up double digits because of tariffs, and US farm equipment is far more costly than tools used in global markets.

Cotton farmers in the United States are desperate for a bailout from Washington, and are pressing lawmakers and the Trump Administration for a new farm bill.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

American farmers are getting hit hard by the trade wars. The high tariffs on fertilizers and equipment are driving up their input costs. And Brazil and Russia, most notably, have dramatically increased their crop exports to China, while retaliatory tariffs on US farm products have made exports from North American farms uncompetitive.

We’ve shared before about corn, wheat, and soybeans. Now we’re watching the same thing in cotton. Brazil’s exports of cotton more than tripled in the first part of last year, up 238%, and Brazilian cotton exports to China were up 14 times, to almost a billion dollars. Now China is the biggest buyer, taking more than half of Brazil’s cotton output.

This year, 2025, it’s more of the same. Brazil’s share of world cotton exports is a new record, at over 30%, passing the United States for the first time, and now Brazil is the world’s top exporter of cotton. Cotton prices grinding lower, dropping by over a third since early last year:

West Texas is a key cotton-growing region in the Untied States, and farmers there are in big trouble. Cotton requires lots of fertilizer, which is going up in price because of the tariffs. The United States gets much of its potash for fertilizers from Canada, and double-digit increases in tariffs are driving the prices up, increasing over 12% overall:

Cotton farmers are also hit with high costs for their equipment. “Cotton pickers cost over $1 million . . . nobody makes a cotton picker but John Deere.” So they “don’t have a choice.”

Let’s stop right there, to point out that John Deere is not the only manufacturer of cotton pickers. This is a used CP770 by Deere, one of their largest cotton harvesters. It’s $933,000.

A cotton picker made in China, with similar specs, costs about half that, new, under $500,000:

The CP690 from John Deere is a little smaller, and costs around half a million dollars used. These machines are five, ten years old. A new Chinese machine, same engine power, costs less than half the price of a used John Deere harvester. And that right there is a huge part of the problem for US farmers. The same capital equipment that is driving high productivity gains in Brazil, in this case, costs less than half as much as what American farmers need to pay. Cotton farmers in Brazil can still make a lot of money with falling prices.

So this year will be an even better year for farmers in Brazil, while things get worse in the United States. Demand for cotton is falling, and China is a primary driver of that.

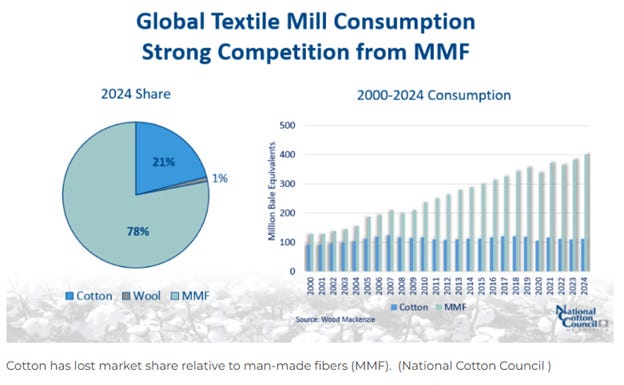

Polyester production in China is growing, and is now twice the size of the global cotton market. China remains a key buyer of American cotton, but at far lower levels than before. Chinese companies are making much more synthetic fibers, and China has moved most of its supply chain for cotton from the US to Brazil. That’s happened in just seven years, when the US market share of Chinese cotton went from 42% to just 17. Prices have been falling ever since.

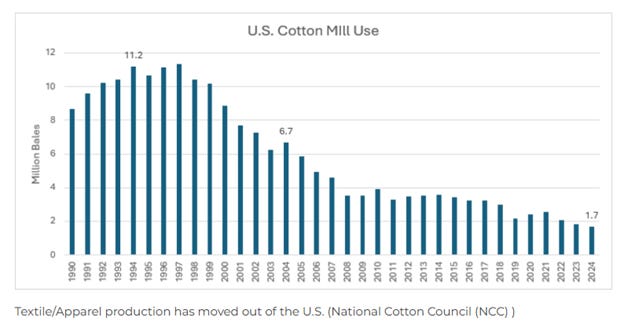

The blue lines in this chart are cotton, and manmade fibers are in gray. 25 years ago, synthetic fabrics production was about 20% higher compared to cotton. Now it’s over 4 times higher. Cotton farmers are complaining here that India, Pakistan, and China are exporting their manmade fabrics duty free, and that contributes to steep declines in production from US cotton mills, about a 75% drop in 20 years:

Cotton farmers now are desperate for a new farm bill that will bail them out. The Rio Grande Valley region has suffered from drought, and floods, and now the tariffs and trade wars are shutting their export markets. The high tariffs caught farmers there leaning the wrong way—the announcements came after they already had crops in the ground, so it was too late to switch. It’s a terrible situation for US farmers, and “an opportunity for Brazil.”

The incentives from Washington have compelled farmers to grow for export markets, instead of for US consumers. Now the export markets are gone, and increased productivity for farmers across the world have pushed prices down, even in the US market.

Resources and links:

John Deere CP770 Cotton Equipment

https://www.machinerypete.com/details/cotton/2024/john-deere/cp770/21683647

https://finviz.com/futures/_charts.ashx?p=d&t=CT

Brazil becomes the world’s largest cotton exporter as production surges

https://macaonews.org/news/lusofonia/brazil-cotton-beef-chicken-commodities-exports/

Brazil tops global cotton exports with 30.5% share in 2024-25 season

‘Shock to the system’: farmers hit by Trump’s tariffs and cuts say they need another bailout

https://www.theguardian.com/us-news/2025/apr/15/farmers-trump-tariffs-bailout-extreme-weather

West Texas cotton: Resilience in the face of adversity

https://www.farmprogress.com/cotton/west-texas-cotton-resilience-in-the-face-of-adversity

Cotton Farmers Describe Somber Situation: ‘We’ve Gone Beyond Losing Money to Now Losing the Farm’

Brazilian cotton exports soar 238% in Jan-Apr, driven by China surge

Farmers are feeling the heat as Trump’s tariffs spike fertilizer prices

Farmers Feel Fertilizer Price Squeeze as Tariffs Hit Ag Sector

Inside China Business, New trade routes from Brazil and Russia are putting US farmers, ranchers out of business

Inside China Business, The Russia-China grains corridor will completely displace the US, Canada, Australia, and France

Inside China Business, New trade routes from Brazil and Russia are putting US farmers, ranchers out of business

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed