Bullets:

Mexico is enacting sweeping tariffs on 1,400 categories of products, intending to protect its domestic manufacturing industries.

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

Tariffs on imported cars and auto parts will rise, up to 50%.

But even at those new, high tariff rates, cars built by Chinese brands will still be competitive in Mexico. Their factories in China are far more efficient than competitors’.

American carmakers such as General Motors, however, face a serious challenge. Most of the cars sold by GM in Mexico are built in China, but at far higher costs than comparable Chinese brands, also building in China for export to Mexico.

Chinese companies in other industries are scaling back investments in Mexico, and instead are considering expansion in Vietnam.

This is a transcript, for the YouTube video found here:

Report:

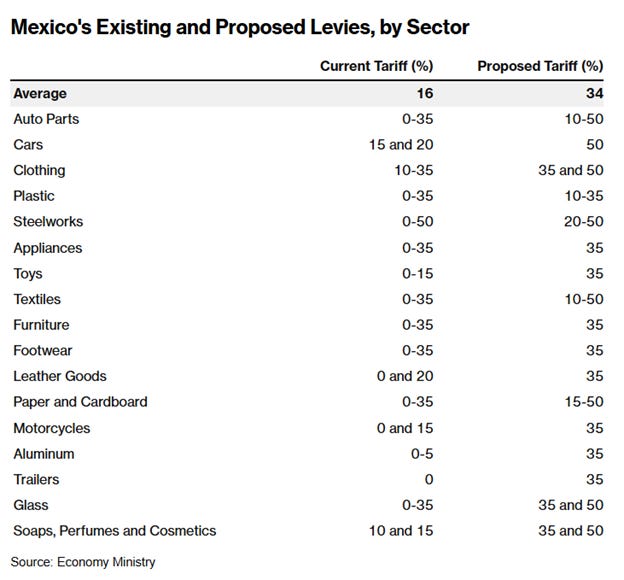

Good morning. The Mexico government is likely to soon enact high tariffs on a wide range of imports. Here is Mexico’s current tariff schedule, which carry an average tariff rate of 16%. That will go to 34% when the new law passes:

Auto parts and cars will see a huge rise, up to 50%. New minimum tariffs will apply to plastics, steel, appliances, toys, textiles, furniture, aluminum, and glass. Also up big on motorcycles and trailers.

Claudia Sheinbaum is president of Mexico, and is trying to here explain that these tariffs are not being done in coordination with the United States, but instead is a national priority to protect its domestic industries. There are over 1,400 categories of products involved. Her government is talking to “embassies for China and South Korea to explain its plans to strengthen the Mexican economy.”

The new tariffs are not yet law, but Chinese companies aren’t waiting; they’re already cutting back investments in the country. The Mexico-China Chamber of Commerce reports that inbound investment is slowing in automotive, auto parts, and metallurgical industries. The tariff issue has generated tremendous uncertainty, and big Chinese firms are already shutting down their investment plans there. A toy company is looking at Vietnam instead, along with an electronics manufacturer. The business models don’t work anymore with the new tariffs on inbound components, for final assembly in plants in Mexico.

That had been a popular business model, and has driven massive Chinese investments into industrial parks across Mexico, especially for products that can be further exported into the US market. That strategy doesn’t work anymore, given the new tariffs from the US, on products coming in from Mexico. And now these new tariffs from Mexico blow up a lot of reasons for some Chinese companies to put final assembly plants into Mexico to serve Mexican consumer markets.

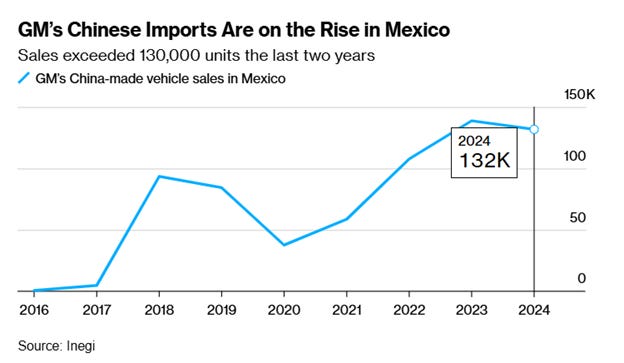

So that is likely to be the first major casualty of the new tariffs. Chinese inbound foreign direct investment is drying up. But another will be American car companies, who build vehicles for the Mexican market using factories here in China. General Motors builds a subcompact that is a top seller in the Mexican market for $17,000, produced by its Chevy factory in China. The car is not available in the United States, naturally, but the Aveo and Onix from Chevy are popular in Mexico.

The new car price in the United States averages nearly $50,000, while in Mexico the average cost of a new car is $32,000. Mexico is a huge market for General Motors, and 65% of GM’s Mexican sales come from China. Over 60,000 cars in the first six months, and in the past two years, 132,000 cars. Across all brands, Chinese car imports are about 20% of Mexico’s new car sales. That’s higher than the US and Japan.

And it’s probably higher than that. BYD is the world’s biggest carmaker, and is a Chinese brand. Geely is another, and neither of them reported their sales data for this analysis. The car industry in China has a superior production scale, and a huge competitive advantage. “Mexico’s policy of welcoming Chinese cars has helped push down prices” there.

The new tariffs on all these inbound vehicles are intended to help Mexico’s domestic carmakers. But cars from Chinese brands are still competitive, even after the new tariffs go on. Their production costs are just lower. The Dolphin Mini is a BYD hatchback which sells in Mexico for $21,500. A comparable vehicle from Chevrolet, the Equinox, has a base price of over twice that.

BYD had plans to open new production centers in Mexico, probably intending to ship most of them North into the American market. Those projects have been put on hold. And so these tariffs present to each company and in each industry a different set of math problems. For many companies and industries, mine included, it doesn’t matter if the tariff is 100 percent, or even more—we don’t have much choice. We either buy from China or do without. American carmakers in China who ship to Mexico, will soon face the same high tariffs as Chinese carmakers in China who ship to Mexico, and we already know how that’s going to go. A price-sensitive Mexican consumer is likely to buy the Chinese brand, even with tariffs of 50%, because there’s nothing else for sale at those price points either.

Resources and links:

Made-in-China Chevys for $17,000 Are Winning Fans in Mexico

Chinese Carmakers May Keep Price Edge Despite Mexico Levies

Bloomberg, Mexico Tariff Plan Is Stopping Chinese Investment, Says Chamber

Sheinbaum aims to calm China tensions after tariff plan backlash

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed