Bullets:

Top VC’s from Western firms and investment banks recently toured Chinese companies in the clean energy industry.

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

After just days, they concluded that China’s advances across the sector make competition impossible, and are pulling funds from Western startups.

They hope to focus now on partnership opportunities with Chinese firms who already dominate the technology and manufacturing, and enjoy access to China’s deep supply chains and logistics.

But that model will also also prove difficult, as China’s entire economic system is designed to destroy rent-seeking profits.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

Business managers and executives who visit China for the first time, and after spending just a few days, are put to a decision. It’s no longer possible to ignore, or explain away, what we’re now seeing for ourselves, firsthand. It doesn’t matter what industry we’re in, and it doesn’t matter how small, or how big and well-established we are. Just as examples, the CEO of Ford Motor company. Venture Capital firms for Artificial Intelligence. International agencies for the nuclear power industry. The reaction is the same for everyone — within a couple of days of checking in to the hotel and looking around, we’re confronted with realities that the world that we thought we lived in doesn’t exist anymore, and never will again.

This entire piece is excellent, and it’s paywalled so we’ll share almost all of it onscreen. A group of Venture Capitalists visited China and saw firsthand, for themselves, China’s dominance in clean tech. And again it doesn’t matter what industry we put there, shipbuilding or electronics or robotics or cars. China’s advances everywhere make competition difficult, and these VC’s decided it’s pointless to try. They’re shutting down new investments in companies unless the projects are somehow in partnership with firms here. This is a regular feature too, that China has prioritized energy security—along with food security and technological security and transportation and medicine. Their economic system is ruthless and failure rates are high, and China is localizing all the supply chains for everything possible. Western companies can’t catch up.

Now it’s safe to say out loud what these VC’s privately feared for a long time. The investment thesis for their entire industry segment is gone. Western firms cannot compete against the Chinese. That was their conclusion after their trip to China.

Talia Rafaeli was at Goldman and Barclays. She assumed that China had caught up and was ahead in some places, but seeing for herself how far ahead makes her realize the companies in Europe and North America probably won’t survive. “Everyone needs to take this kind of trip”, and we are past wondering by now just why a top executive at the world’s top investment banks had never done it before, but better late than never. That sure seems to happen a lot more than it should, where people are lavishly paid to know what’s going on in their industry, and somehow missed that China had already taken it over.

Anyway, these Venture Capitalists are heads of firms with portfolios that collectively total hundreds of companies, and dozens of exits. I stopped counting at 200, so these guys are deeply experienced in the clean energy space. These VC’s in particular make early-stage investments in clean tech companies to fund their expansion, in the hopes they’ll go to a public offering, or get acquired by a bigger company. At that point, their firms can book big profits on the “exit”, as it’s called. And now after a few days in China, they have a new goal: get out of any company that can’t compete with anything that the Chinese are doing.

Planet A Ventures is out of Berlin, and their website is typical of other Venture Capital companies. A nice intro, an introduction to the team, and a portfolio of their current and previous investments. Nick de la Forge invests in startups in battery manufacturing and recycling, solar and wind, and says those sectors are now off the list from now on.

Extantia Capital took a look around Chinese battery cell manufacturers, and said it’s “game over” for any Western company trying to build them. Only way to make money is to partner with China for supply chains, which is also probably a non-starter.

Energy Impact Partners is another VC firm, with over a hundred investments if we count exits. A top partner there came to China and declared that Western investors are in a bubble, believing things about China that just aren’t true.

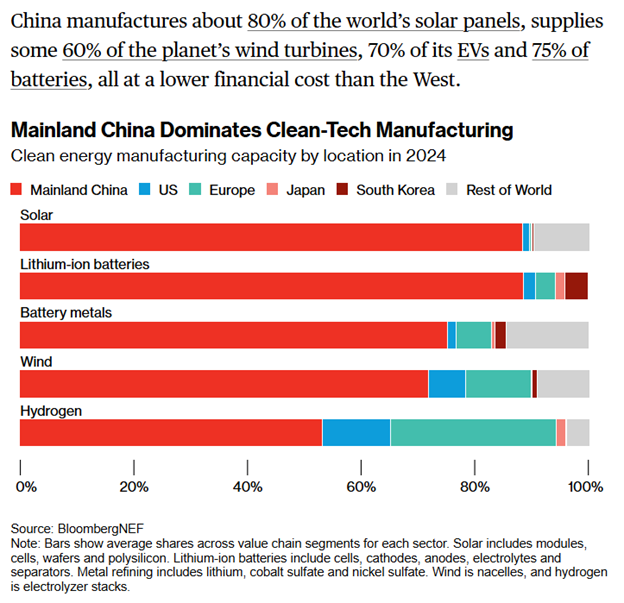

This is where things stand on manufacturing for Clean Energy Tech:

Red is China, the other colors are everywhere else in the world. 90% of all the world’s solar manufacturing is here. Batteries. Metals for the batteries at 75, give or take. In wind power 70. Hydrogen tech, China still is more than the rest of the world combined.

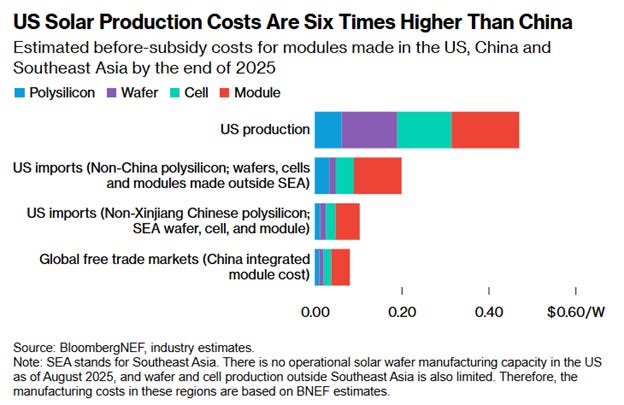

Another problem: all this happens at lower costs. In solar, production costs in the United States are six times what it costs here. And this table is misleading, because the US doesn’t even make solar wafers, and Southeast Asian countries produce almost all wafers and solar cells, so new firms either need to figure out how to build those, or buy those inputs from here anyway.

New companies that want to take market share from China need to compete with established players here, who already have the low-cost advantage. Then comes the supply chain problem, because China has that too. As a bonus, this is where all the smart people are, with three fourths of the world’s patents in the industry now coming out of Chinese labs.

Irena Spazzapan was at Goldman and now runs money for Sytemiq, in London. “China’s advances in the renewables space result from their drive for energy independence.”

So these are all unfixable problems, because there’s no place to even start. The raw materials that feed these industries are pulled out of the ground by Chinese companies operating across the world, then they’re put on Chinese-run railroads and ships, and brought to Chinese refineries and fabs in Mainland China. The entire system is designed to make sure, all those red bars stay red.

Those are the challenges that face Western companies trying to break in, and the VC’s who invest in Western companies. This section here speaks to another problem we all have, when trying to describe the Chinese economic system. It’s definitely not anything like the Socialism or Communism that we learned about growing up. But China isn’t capitalist either, at least not in any way that these Venture Capitalists are hoping for. The business model that made them rich in New York or London or Berlin won’t work here, at all. In China, scale comes before profits. The state benefits, the consumers benefit, but investors not nearly as much. Beijing is relaxed about hundreds of companies going under, because the handful of companies that do survive here dominate the world. Corporate Darwinism is the rule here, and even successful VC’s are shocked by the extent of it.

And that leads to a final problem. Companies that compete against Chinese firms are already in trouble. Investors in Chinese companies don’t enjoy the outsized, rent-seeing returns that Western investors insist on back home. So one option seems to be to partner with Chinese companies.

Trouble with that idea is right here. Marvel Tech is a Shanghai company that builds gas turbines that can run on anything. Gang Lin is CEO, and according to him everything his guys need to build those things is right next door. His suppliers are local, and they do whatever it takes to keep his business. Marvel has the same problem other Chinese companies do—profits are hard to come by in Mainland China, because the competition is so strong, so they’re looking for export markets. Same thing at GCL, who builds solar modules.

But here again we see the difference in business models. These companies already have proof-of-concept. They don’t need VC money to fund the research and development, that’s already done. Their products are already in the market, generating cash flow. That cash flow gets reinvested to produce at scale, not distributed to private investors in dividends or capital gains, or investment banking fees.

And that’s the same model that built the champions like BYD and CATL. These companies are vertically integrated in ways that no Western company is anymore. They down the entire research, production, and marketing stacks. Jacob Bro is also out of Berlin, he spent a few minutes watching a production line at CATL and says nobody is going to catch them either. We did a report on Northvolt earlier, a European battery producer that collapsed, and Bro wonders here if Northvolt might still be around if they had Chinese partners to help them.

These VC’s represent billions of dollars of capital, and what is still unsaid is what this means for the business model of Venture Capital itself. A VC fund that invests in clean energy needs projects to invest in, or they have to close the fund and do something else. After a few days in China they realized they need to do something else. They just don’t know what.

Be Good.

Resources and links:

Bloomberg, China Road Trip Exposes List of Uninvestable Assets in the West

Ford Motor CEO visits China, sees existential threats and opportunities, and overhauls the company

China’s “overcapacity” was always deliberate: US experts stunned by Chinese AI, declare race is over

China flips nuclear sanctions upside down: now Western regulators are banning Chinese nuke tech

VC company profiles:

https://www.bloomberg.com/profile/company/2106982D:LN

https://www.energyimpactpartners.com/

Thanks for reading Inside China / Business! Subscribe for free to receive new posts and support my work.

From Inside China / Business via this RSS feed